This course consists of five blocks containing 22 units in all. This course introduces you to the basic accounting concepts and framework. It also covers the preparation of accounts of non-trading and those from incomplete records. After studying this course, you should be able to: • Understand the whole process of accounting • Work out the net result of business operations by preparing final accounts for both trading and non-trading concerns • Appropriate special features of accounting fro consignments and joint ventures • Describe different methods of providing depreciation • Explain the need for making provisions and various kinds of reserves

Unit 1 : Basic Concepts of Accounting

Unit 2 : The Accounting Process

Unit 3 : Cash Book and Bank Reconciliation

Unit 4 : Other Subsidiary Books

Unit 5 : Bills of Exchange

Unit 6 : Concepts Relating to Final Accounts

Unit 7 : Final Accounts-I

Unit 8 : Final Accounts-II

Unit 9 : Errors and their Rectification

Unit 10 : Consignments Accounts-I

Unit 11 : Consignments Accounts-II

Unit 12 : Consignments Accounts-III

Unit 13 : Joint Venture Accounts

Unit 14 : Self Balancing System

Unit 15 : Accounting from Incomplete Records-I

Unit 16 : Accounting from Incomplete Records-II

Unit 17 : Accounting from Incomplete Records-III

Unit 18 : Accounts of Non-trading Concerns-I

Unit 19 : Accounts of Non-trading Concerns-II,

Unit 20 : Depreciation-I

Unit 21 : Depreciation-II

Unit 22 : Provisions and Reserves

The course was fantastic! It covered everything from using Windows and MS Office to browsing the internet safely. The instructors were patient and explained everything in simple terms. ???

I had zero knowledge about computers, but the Basics of Computer course at Attitude Academy made everything so easy to understand. Now I feel confident using software and the internet. Highly recommend for beginners!

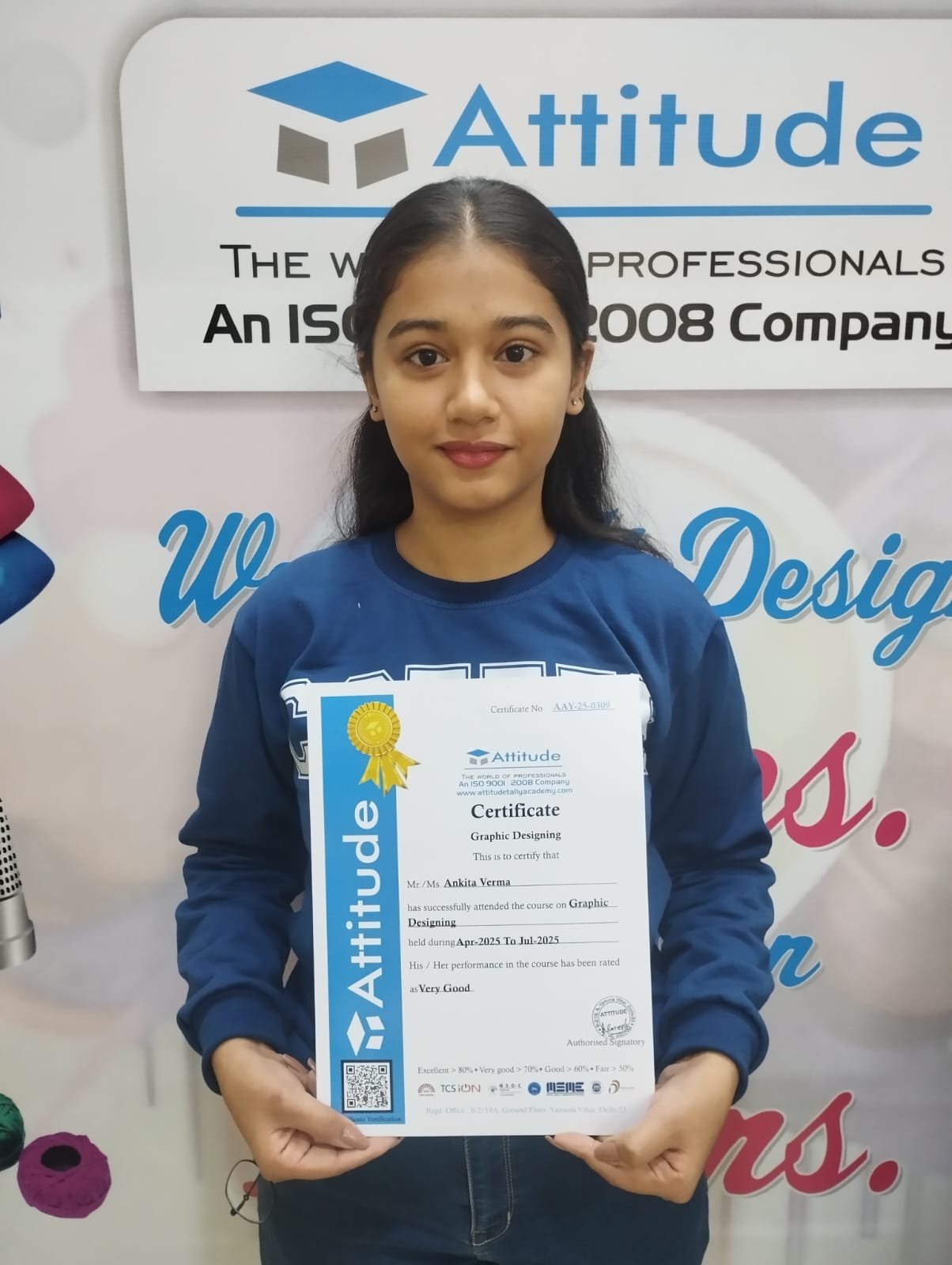

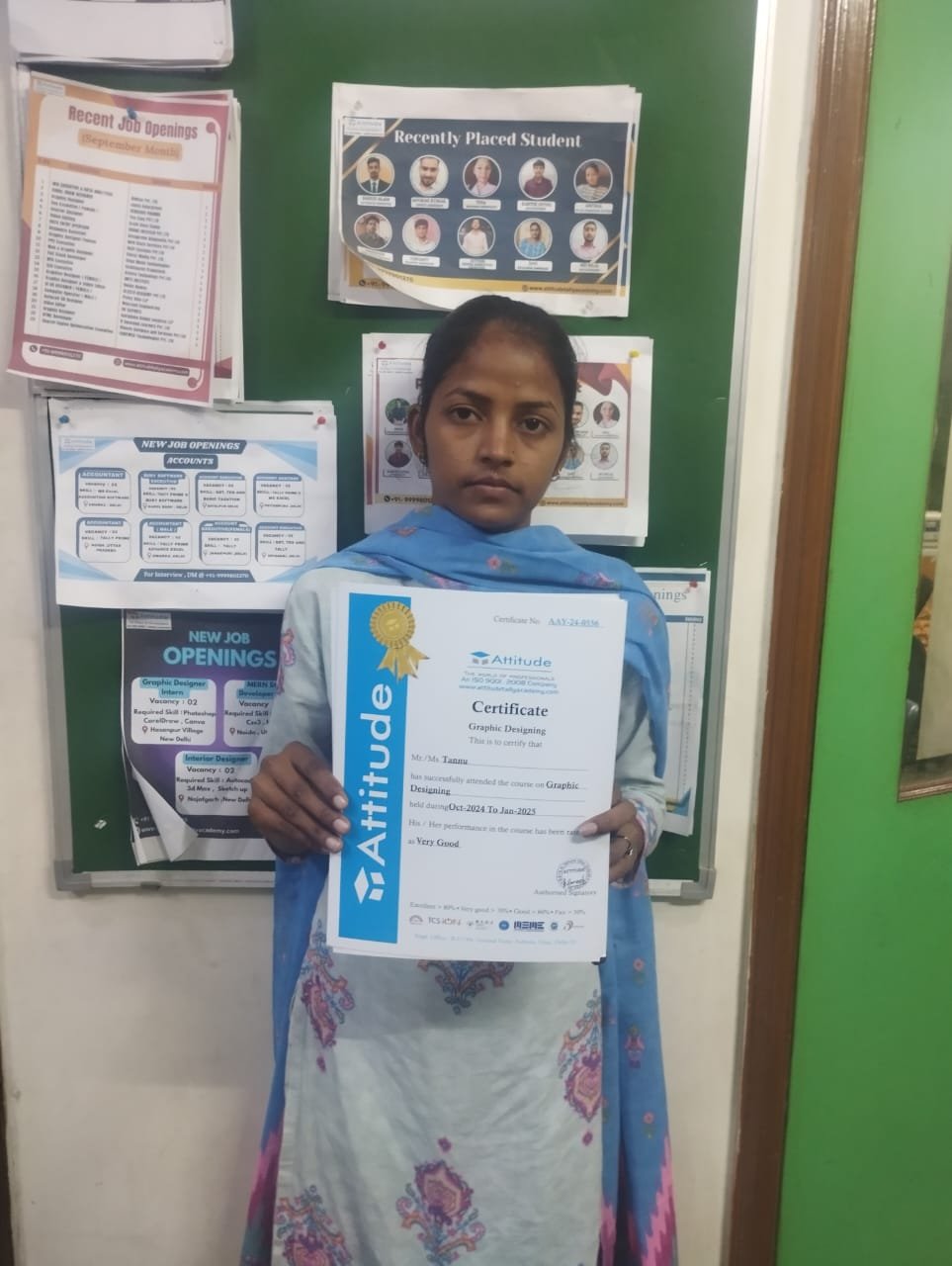

Attitude Academy’s Graphic Designing course in Yamuna Vihar is amazing! The trainers are very experienced and break down complex design concepts into easy-to-understand lessons. The hands-on experience with software like Photoshop and Ill

Attitude Academy’s Multi Autodesk course in Yamuna Vihar is a game-changer! The instructors are top-notch and provide personalized attention. The practical lessons on AutoCAD, Revit, and 3Ds Max have been incredibly helpful. I’m now con

Attitude Academy\'s MIS & Data Analytics course in Yamuna Vihar is top-notch! The trainers are highly experienced, and the practical sessions make learning fun. I’ve gained skills that are directly applicable to my career. Highly recommen

Attitude Academy\'s MIS & Data Analytics course in Yamuna Vihar is top-notch! The trainers are highly experienced, and the practical sessions make learning fun. I’ve gained skills that are directly applicable to my career. Highly recommen

I had zero knowledge about computers, but the Basics of Computer course at Attitude Academy made everything so easy to understand. Now I feel confident using software and the internet. Highly recommend for beginners! ??

Attitude Academy’s MIS & Data Analytics course has been a game-changer for my career! The trainers are highly knowledgeable, and the course covers all aspects of data management and analysis. The hands-on approach helped me apply my skill

I’ve been enrolled in the MIS & Data Analytics course at Attitude Academy for a few months, and I’m amazed at how quickly I’ve learned. The practical examples and assignments are spot-on, and I now feel confident analyzing large data

I joined this course with no prior computer knowledge, and now I can use a computer comfortably for work and personal tasks. The instructors were very supportive and the learning environment was great. ???

Enrolling in the Computer Science course at Attitude Academy was a game-changer for me. The trainers are highly knowledgeable and provide excellent support. The course covers all key topics like algorithms, data structures, and more. The pr

Enrolled in the MIS & Data Analytics program at Attitude Academy, and it’s been a game-changer! The course covers everything from basic concepts to advanced data handling. The live projects were really helpful in building confidence.

I enrolled in Attitude Academy’s e-accounting course, and it was a great decision! The course covers practical aspects of accounting software like Tally, GST, and taxation. The trainers are highly knowledgeable and provide hands-on suppor

Attitude Academy’s Multimedia and Graphic Designing course in Uttam Nagar was an amazing experience! The curriculum covered everything from Photoshop to animation. The trainers are experts and provided hands-on projects that boosted my sk

Attitude Academy’s Multimedia and Graphic Designing course in Uttam Nagar was an amazing experience! The curriculum covered everything from Photoshop to animation. The trainers are experts and provided hands-on projects that boosted my sk

Attitude Academy\'s MIS & Data Analytics course in Yamuna Vihar is top-notch! The trainers are highly experienced, and the practical sessions make learning fun. I’ve gained skills that are directly applicable to my career. Highly recommen

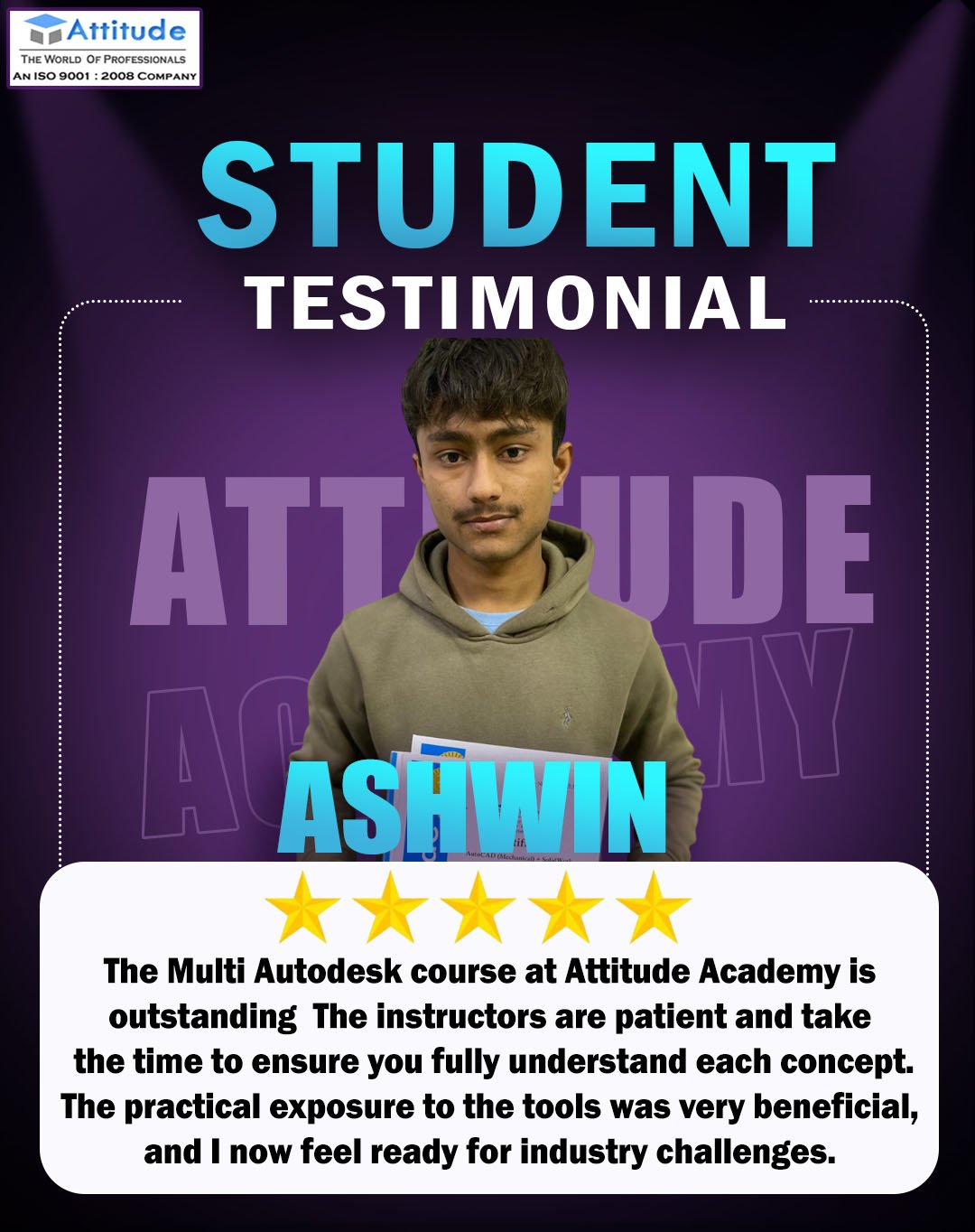

The Multi Autodesk course at Attitude Academy is outstanding! The instructors are patient and take the time to ensure you fully understand each concept. The practical exposure to the tools was very beneficial, and I now feel ready for indus

Attitude Academy’s MIS & Data Analytics course has been a game-changer for my career! The trainers are highly knowledgeable, and the course covers all aspects of data management and analysis. The hands-on approach helped me apply my skill

The course was fantastic! It covered everything from using Windows and MS Office to browsing the internet safely. The instructors were patient and explained everything in simple terms. ???

Enrolling in the MIS & Data Analytics program at Attitude Academy was one of the best decisions I’ve made for my career. The classes are well-organized, and the faculty is dedicated to helping students succeed. I’ve gained a lot of prac

\"I had an amazing experience at Attitude Academy’s Graphic Designing course. The trainers were very knowledgeable and provided personalized attention. The course was comprehensive, covering everything from typography to color theory. I f

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave

Attitude Academy’s Graphic Designing course in Yamuna Vihar was truly a game-changer for me! The course is well-structured, and the trainers explain everything in detail. The hands-on assignments gave me the confidence to start creating m

I’ve been enrolled in the MIS & Data Analytics course at Attitude Academy for a few months, and I’m amazed at how quickly I’ve learned. The practical examples and assignments are spot-on, and I now feel confident analyzing large data

I’ve been enrolled in the MIS & Data Analytics course at Attitude Academy for a few months, and I’m amazed at how quickly I’ve learned. The practical examples and assignments are spot-on, and I now feel confident analyzing large data

I had an amazing experience at Attitude Academy’s e-accounting course. The trainers are experts in accounting software, and they break down even the most complex topics into easy-to-understand lessons. I now feel well-prepared for a caree

Attitude Academy’s Multi Autodesk course in Yamuna Vihar is hands down the best training I’ve received. The instructors are extremely knowledgeable, and the hands-on approach helped me grasp everything quickly. I now feel confident usin

This course was a great introduction to computers. I now understand how to use MS Word, Excel, and browse the internet. The lessons were practical, and the instructors were friendly and supportive. ???

Attitude Academy’s MIS & Data Analytics course has been a game-changer for my career! The trainers are highly knowledgeable, and the course covers all aspects of data management and analysis. The hands-on approach helped me apply my skill

The Digital Marketing course at Attitude Academy in Yamuna Vihar was exactly what I needed! The trainers are very knowledgeable and explained every topic in depth. From SEO to Google Ads, the course covered all areas, and the assignments he

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and enga

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and enga

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and enga

I can’t thank Attitude Academy enough for this course! The lessons were interactive, and I gained hands-on experience working on real web development projects. Now, I’m confident in my ability to create websites and web apps. ??

I can’t thank Attitude Academy enough for this course! The lessons were interactive, and I gained hands-on experience working on real web development projects. Now, I’m confident in my ability to create websites and web apps. ??

I completed Dress Designing & Tailoring Training here. The faculty is very creative and supports practical learning. Perfect place for fashion career aspirants.”

The course is perfect for anyone who wants to learn web development from scratch. I started with no knowledge and now I can build full websites using HTML, CSS, and JavaScript. The instructors were always supportive and provided excellent r

The e-accounting course at Attitude Academy was exactly what I needed! It covered everything from GST to managing financial statements. The trainers are knowledgeable, and the assignments gave me practical experience. I feel confident to ta

The Multi Autodesk course at Attitude Academy is hands down one of the best courses I’ve taken. The instructors are industry experts who really know their stuff. They focus on real-world applications, and I’ve already started using what

The course is perfect for anyone who wants to learn web development from scratch. I started with no knowledge and now I can build full websites using HTML, CSS, and JavaScript. The instructors were always supportive and provided excellent r

The course is perfect for anyone who wants to learn web development from scratch. I started with no knowledge and now I can build full websites using HTML, CSS, and JavaScript. The instructors were always supportive and provided excellent r

I completed Dress Designing & Tailoring Training here. The faculty is very creative and supports practical learning. Perfect place for fashion career aspirants.”

Attitude Academy’s Graphic Designing course is top-notch! The trainers explain design concepts in a way that’s easy to understand, and the hands-on projects helped me develop real-world skills. I can now create professional designs for

Attitude Academy’s computer basics course is perfect for anyone looking to improve their computer skills. The lessons are easy to understand, and the instructors are very patient. ???

Attitude Academy’s Fashion Designing course is perfect for anyone looking to build a career in fashion. The course covers everything you need to know—from sketching and design concepts to fabric selection and garment stitching. The trai

Attitude Academy’s Graphic Designing course is top-notch! The trainers explain design concepts in a way that’s easy to understand, and the hands-on projects helped me develop real-world skills. I can now create professional designs for

Attitude Academy’s Graphic Designing course is top-notch! The trainers explain design concepts in a way that’s easy to understand, and the hands-on projects helped me develop real-world skills. I can now create professional designs for

I had an incredible experience at Attitude Academy’s Digital Marketing course in Yamuna Vihar. The trainers explained every concept in detail, and the hands-on projects were very helpful. I now have the skills to run successful digital ma

The Multi Autodesk course at Attitude Academy is hands down one of the best courses I’ve taken. The instructors are industry experts who really know their stuff. They focus on real-world applications, and I’ve already started using what

Enrolling in the MIS & Data Analytics program at Attitude Academy was one of the best decisions I’ve made for my career. The classes are well-organized, and the faculty is dedicated to helping students succeed. I’ve gained a lot of prac

Enrolling in the MIS & Data Analytics program at Attitude Academy was one of the best decisions I’ve made for my career. The classes are well-organized, and the faculty is dedicated to helping students succeed. I’ve gained a lot of prac

Attitude Academy’s computer basics course is perfect for anyone looking to improve their computer skills. The lessons are easy to understand, and the instructors are very patient. ???

Enrolling in the MIS & Data Analytics program at Attitude Academy was one of the best decisions I’ve made for my career. The classes are well-organized, and the faculty is dedicated to helping students succeed. I’ve gained a lot of prac

The Multi Autodesk course at Attitude Academy is hands down one of the best courses I’ve taken. The instructors are industry experts who really know their stuff. They focus on real-world applications, and I’ve already started using what

I completed Dress Designing & Tailoring Training here. The faculty is very creative and supports practical learning. Perfect place for fashion career aspirants.”

Enrolling in the MIS & Data Analytics program at Attitude Academy was one of the best decisions I’ve made for my career. The classes are well-organized, and the faculty is dedicated to helping students succeed. I’ve gained a lot of prac

Attitude Academy’s Graphic Designing course is top-notch! The trainers explain design concepts in a way that’s easy to understand, and the hands-on projects helped me develop real-world skills. I can now create professional designs for

The Graphic Designing course at Attitude Academy in Yamuna Vihar was incredible! The trainers are very supportive and ensure that every student grasps the concepts. I learned how to use industry-standard software and improve my design skill

The Graphic Designing course at Attitude Academy in Yamuna Vihar was incredible! The trainers are very supportive and ensure that every student grasps the concepts. I learned how to use industry-standard software and improve my design skill

The Graphic Designing course at Attitude Academy in Yamuna Vihar was incredible! The trainers are very supportive and ensure that every student grasps the concepts. I learned how to use industry-standard software and improve my design skill

The Graphic Designing course at Attitude Academy in Yamuna Vihar was incredible! The trainers are very supportive and ensure that every student grasps the concepts. I learned how to use industry-standard software and improve my design skill

In today’s fast-paced digital world, traditional accounting methods are being replaced by smarter, faster, and more efficient online solutions. Our E-Accounting course will not only teach you how to manage finances but also help you maste

The Graphic Designing course at Attitude Academy in Yamuna Vihar exceeded my expectations! The course content was detailed, and the trainers were always available to answer questions. I now feel confident using design software like Photosho

Attitude Academy’s Digital Marketing course in Yamuna Vihar is amazing! It covers everything, from SEO basics to advanced Google Ads strategies. The trainers are very knowledgeable and provide great real-world examples. I now feel confide

In today’s fast-paced digital world, traditional accounting methods are being replaced by smarter, faster, and more efficient online solutions. Our E-Accounting course will not only teach you how to manage finances but also help you maste

The Interior Designing course is very practical — from AutoCAD to 3D visualization & site visits. Perfect institute for creative careers with strong mentor support.”

Attitude Academy\'s web development course gave me a solid foundation in coding. The course was structured in a way that made learning enjoyable. The instructors were knowledgeable, and I gained real-world experience by building live projec

Attitude Academy offers an exceptional Autodesk course. The Multi Autodesk program covers everything from AutoCAD drafting to 3D modeling in Revit, making it ideal for anyone looking to gain comprehensive skills. The instructors provide gre

The Multi Autodesk course at Attitude Academy was very well-structured. It covered everything from AutoCAD basics to advanced 3Ds Max techniques. The trainers are extremely helpful and take the time to explain every concept thoroughly. I’

The Graphic Designing course at Attitude Academy is excellent! The trainers are very experienced and provide clear, step-by-step instructions. I’ve learned how to create professional designs using Adobe Photoshop and Illustrator. The cour

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave

Thank you for your feedback! We’re happy the course and expert trainers have helped you feel well-prepared for your digital marketing career. Best of luck!

Attitude Academy’s course on MIS & Data Analytics has exceeded all my expectations. The curriculum is well-structured, with real-time applications that make learning fun and engaging. The trainers ensure that every student gets individual

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave

The Graphic Designing course at Attitude Academy is excellent! The trainers are very experienced and provide clear, step-by-step instructions. I’ve learned how to create professional designs using Adobe Photoshop and Illustrator. The cour

Attitude Academy’s course on MIS & Data Analytics has exceeded all my expectations. The curriculum is well-structured, with real-time applications that make learning fun and engaging. The trainers ensure that every student gets individual

Attitude Academy’s course on MIS & Data Analytics has exceeded all my expectations. The curriculum is well-structured, with real-time applications that make learning fun and engaging. The trainers ensure that every student gets individual

I loved this course! The Basics of Computer course at Attitude Academy made learning easy and enjoyable. The instructors helped me become comfortable using computers for daily tasks. Highly recommend it! ??

The Graphic Designing course at Attitude Academy is excellent! The trainers are very experienced and provide clear, step-by-step instructions. I’ve learned how to create professional designs using Adobe Photoshop and Illustrator. The cour

The Multi Autodesk course at Attitude Academy was very well-structured. It covered everything from AutoCAD basics to advanced 3Ds Max techniques. The trainers are extremely helpful and take the time to explain every concept thoroughly. I’

The Multi Autodesk course at Attitude Academy was very well-structured. It covered everything from AutoCAD basics to advanced 3Ds Max techniques. The trainers are extremely helpful and take the time to explain every concept thoroughly. I’

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave

The course was very informative! It taught me everything from setting up a computer to using various software programs. The practical exercises helped me understand the material better. Highly recommend! ???

The Graphic Designing course at Attitude Academy in Yamuna Vihar exceeded my expectations! The course content was detailed, and the trainers were always available to answer questions. I now feel confident using design software like Photosho

The Graphic Designing course at Attitude Academy in Yamuna Vihar exceeded my expectations! The course content was detailed, and the trainers were always available to answer questions. I now feel confident using design software like Photosho

The Interior Designing course is very practical — from AutoCAD to 3D visualization & site visits. Perfect institute for creative careers with strong mentor support.”

The Interior Designing course is very practical — from AutoCAD to 3D visualization & site visits. Perfect institute for creative careers with strong mentor support.”

The Interior Designing course is very practical — from AutoCAD to 3D visualization & site visits. Perfect institute for creative careers with strong mentor support.”

Attitude Academy\'s MIS & Data Analytics course in Yamuna Vihar is top-notch! The trainers are highly experienced, and the practical sessions make learning fun. I’ve gained skills that are directly applicable to my career. Highly recommen

Attitude Academy’s Digital Marketing course in Yamuna Vihar exceeded my expectations! The course covered everything from SEO and social media to Google Ads. The trainers are industry experts and provided hands-on learning, making it easy

Attitude Academy’s computer basics course is perfect for anyone looking to improve their computer skills. The lessons are easy to understand, and the instructors are very patient. ???

Attitude Academy’s Graphic Designing course in Yamuna Vihar is amazing! The trainers are very experienced and break down complex design concepts into easy-to-understand lessons. The hands-on experience with software like Photoshop and Ill

The Multi Autodesk training at Attitude Academy was absolutely incredible! The trainers are experts and make even the most complex topics easy to understand. I learned practical skills that I’m already using in my freelance work. I highly

I had an amazing experience at Attitude Academy. The Multi Autodesk course is extremely detailed, and the instructors go above and beyond to help. From AutoCAD basics to advanced Revit modeling, the course offers a well-rounded learning exp

The Digital Marketing course at Attitude Academy in Yamuna Vihar is a great learning experience! It covered everything—SEO, SEM, and content marketing. The trainers are very knowledgeable and always ready to help. The practical approach m

The course was fantastic! It covered everything from using Windows and MS Office to browsing the internet safely. The instructors were patient and explained everything in simple terms. ???

The Spoken English & PDP course at Attitude Academy has been life-changing! The trainers are very knowledgeable and make learning enjoyable. The classes focus on practical communication, which made me feel confident speaking English in real

The course was very hands-on, with lots of practical exercises. I learned everything from HTML to advanced JavaScript, and I’m now able to build dynamic websites. The instructors were super helpful and encouraging throughout the course! ?

The Digital Marketing course at Attitude Academy in Yamuna Vihar is a great learning experience! It covered everything—SEO, SEM, and content marketing. The trainers are very knowledgeable and always ready to help. The practical approach m

The Graphic Designing course at Attitude Academy is fantastic! I learned everything from the basics of design to advanced techniques in Photoshop and Illustrator. The trainers are supportive and knowledgeable. I feel ready to start my caree

The course was fantastic! It covered everything from using Windows and MS Office to browsing the internet safely. The instructors were patient and explained everything in simple terms. ???

Enrolled in the MIS & Data Analytics program at Attitude Academy, and it’s been a game-changer! The course covers everything from basic concepts to advanced data handling. The live projects were really helpful in building confidence.

The Graphic Designing course at Attitude Academy is fantastic! I learned everything from the basics of design to advanced techniques in Photoshop and Illustrator. The trainers are supportive and knowledgeable. I feel ready to start my caree

Attitude Academy’s Multi Autodesk course in Yamuna Vihar is a game-changer! The instructors are top-notch and provide personalized attention. The practical lessons on AutoCAD, Revit, and 3Ds Max have been incredibly helpful. I’m now con

Thank you for your amazing review! ? We're so happy to hear you're confident with computers now. Keep exploring and learning! ?

Attitude Academy’s Graphic Designing course in Yamuna Vihar is amazing! The trainers are very experienced and break down complex design concepts into easy-to-understand lessons. The hands-on experience with software like Photoshop and Ill

This is one of the best institute for Autocad Training. I recommend everyone should study from Mohsin sir class and join his batch only, he is very knowledgeable and expert in this industry. He always explains the concepts very clearly and

It has been a great experience for me to take fashion and dress designing training from attitude academy. I have taken fashion and dress designing course .the trainer especially anjali mam is very good and has good knowledge. I have also go

I recently completed the Interior Designing training course at Attitude Academy, and it exceeded my expectations. The trainer's expertise and the excellent learning environment made the experience remarkable. The study material was top-notc

It has been a great experience for me to take Autocad 3d's Max training from Attitude Academy. I have taken Autocad course. The trainer especially Sumit Sir is very good and has good knowledge. I have also got a placement from here. The pla

It was such a great experience to study AutoCAD course, I have learned a lot about my strengths and weaknesses with the help of my amazing tutors. Now I believe I am more capable of teaching different skills effectively.

While starting the course I was lacking motivation but as I learned to go with flow and explored different topics, faculty at Attitude Academy helped me by taking care of all the doubts. Thus, ensuring my clarity in the subjects.

My experience with Attitude Academy has been great. Now, I can say that I have a strong foundation in programming, This course gave me a taste of developing websites which helped me build some interesting projects for my portfolio.

Best academy for smart courses and good facilities

Wonderful dresses I am stitching for myself, my family and the institute, after learning dress designing from this institute. So happy...

Best FD and DD, I am doing 6 months course from here, Anjali and Divya mam are best. Such an experienced and great faculty of fashion and dress designing here.

I have Completed my Tally.ERP9 Course with good experience. And now I feel that I am very confident about my interview and job.