TallyPrime With GST

Basic knowledge of Functional of Computer

7 Days Money-Back Guarantee*

Take the final exam online to complete the TallyPrime With GST after which you will be able to download your certificate from Attitude Trainings

Basic knowledge of Functional of Computer

Watch the recorded & live videos to learn various concepts & get Live Sessions for Doubts Clearing

Test your knowledge through quizzes & module tests

Get hands on practice by doing assignments and project

Take the final exam to get certified in TallyPrime With GST

Advanced Financial Accounting with TallyPrime and GST

Fundamentals of TallyPrime

Create Accounting Masters in TallyPrime

Accounting Vouchers

Financial Statements and Accounting Books & Reports

Application Management

Online Help and Support

TallyPrime ODBC

Remote Access

Unit Creating In Inventory

Godown Creation

Inventory Vouchers

Generating Inventory Books & Reports

Purchase/Sale Order

Cost Centres and Cost Categories

Voucher Classes

Zero Value Entry

Additional Cost Of Purchase

Price Levels/Price List

Multiple Currencies

Interest Calculations

Budget & Controls

Scenario Management

Banking

Tracking Numbers

Batch – wise Details

Bill of Materials (BoM)

Stock Valuation

Inventory Analysis

Different Actual and Billed Quantities

Job Costing

Job Order Processing

Generation Employees

Salary Structure

Calculation Attendance & Leave Details

Salary Slip Generation, PF, ESI, Gratuity Bonus,

Various Analytical Reports etc.

Activating GST for Your Company

Setting Up GST Rates

Updating Stock Items and Stock Groups for GST Compliance

Updating a Service Ledger for GST Compliance

Updating Sales and Purchase Ledgers for GST Compliance

Updating Party GSTIN.

Creating GST Ledgers

Recording Sales and Printing Invoices

Recording Purchases

Sales - Nil Rated, Exempt

Recording Sales Returns

Recording Purchase Returns

GSTR-1, GSTR-2, GSTR-3, GSTR-2A

Returns Summary

Table-wise GSTR-1, GSTR-3

Exporting GSTR-1 ,GSTR-2, GSTR-3, GSTR-9

GST Reports

Communication, Listening & Comprehension, Real Life Scenarios,

Interview Skills

Special Classes on PDP (Body Language) etc.

TCS(Tax Collected At Source) Entry

Challans Of TDS & TCS

Form of TDS & TCS

Reports of TDS & TCS

Watch the recorded & live videos to learn various concepts & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests

Get hands on practice by doing assignments and project

Take the final exam to get certified in TallyPrime With GST

You can post your doubts on the Q&A forum which will be answered by the teachers within 24 hours.

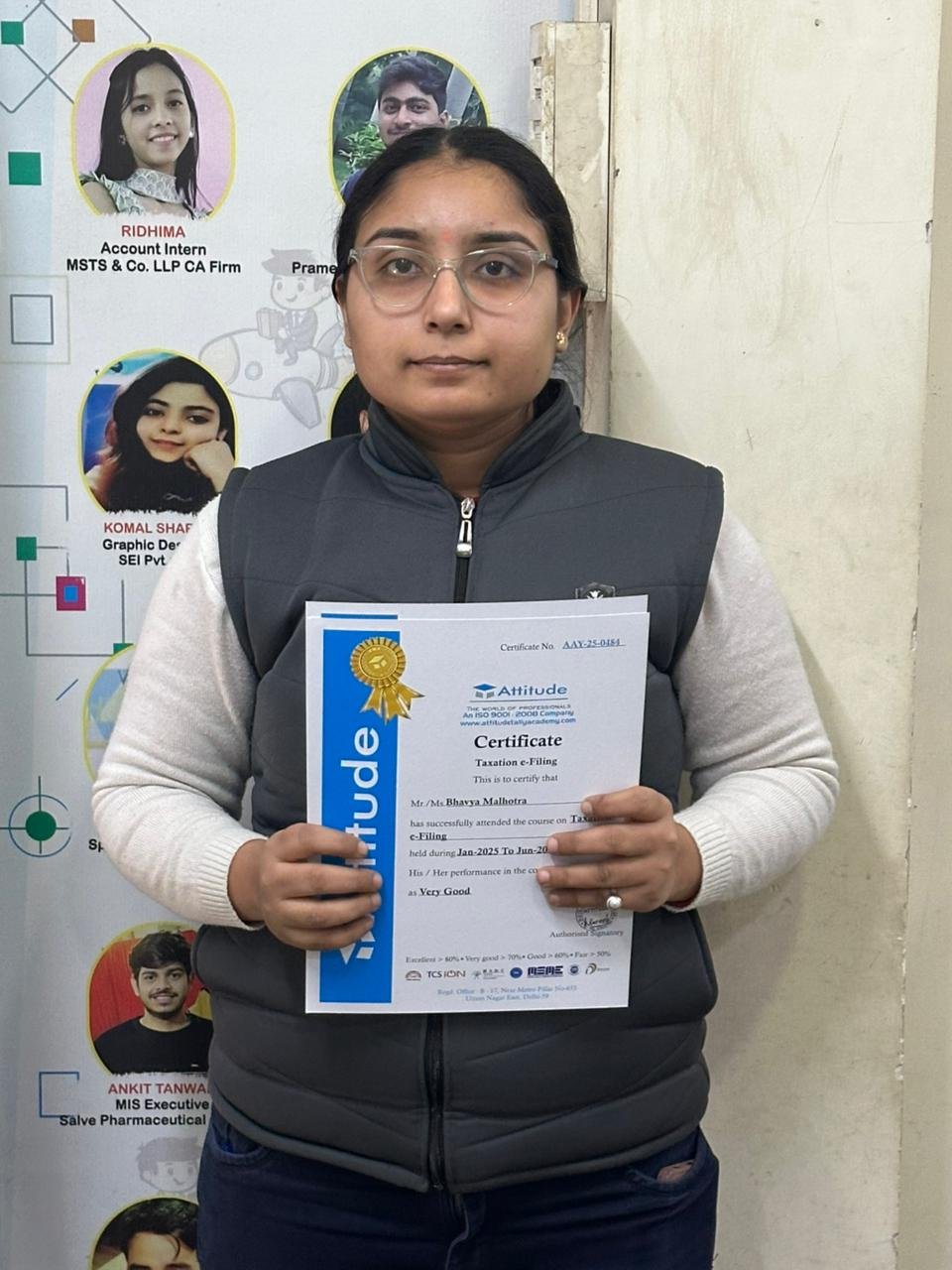

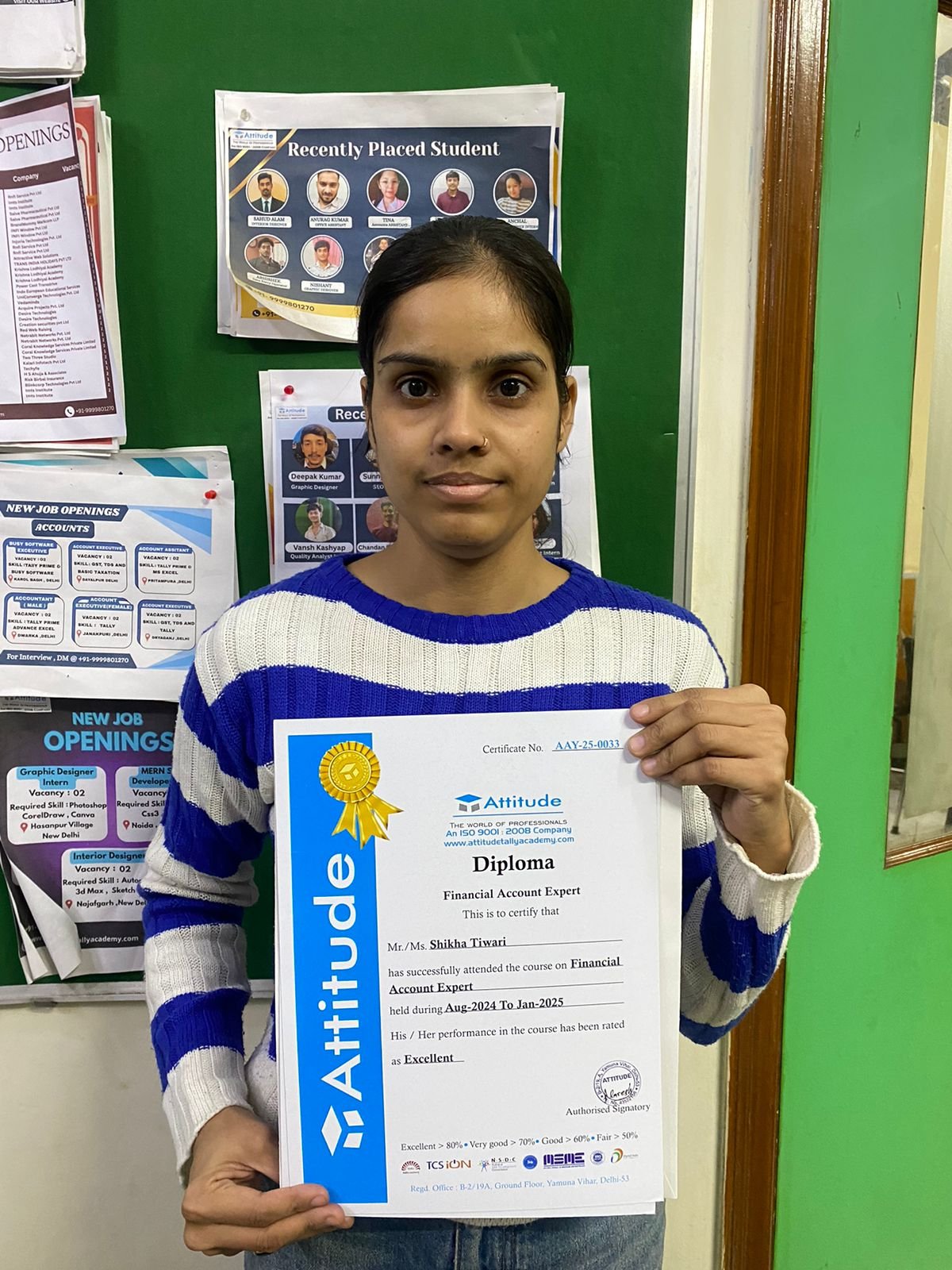

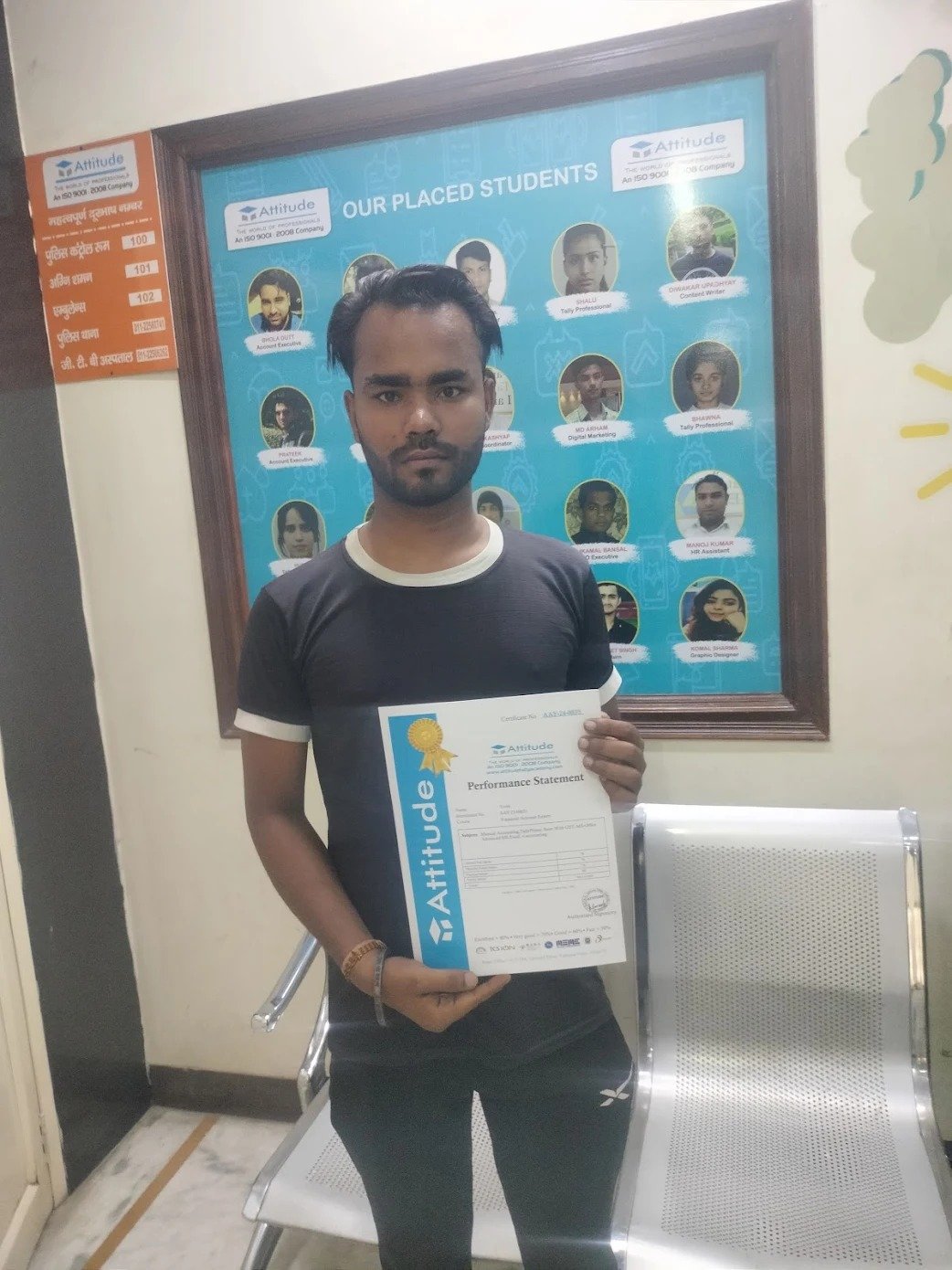

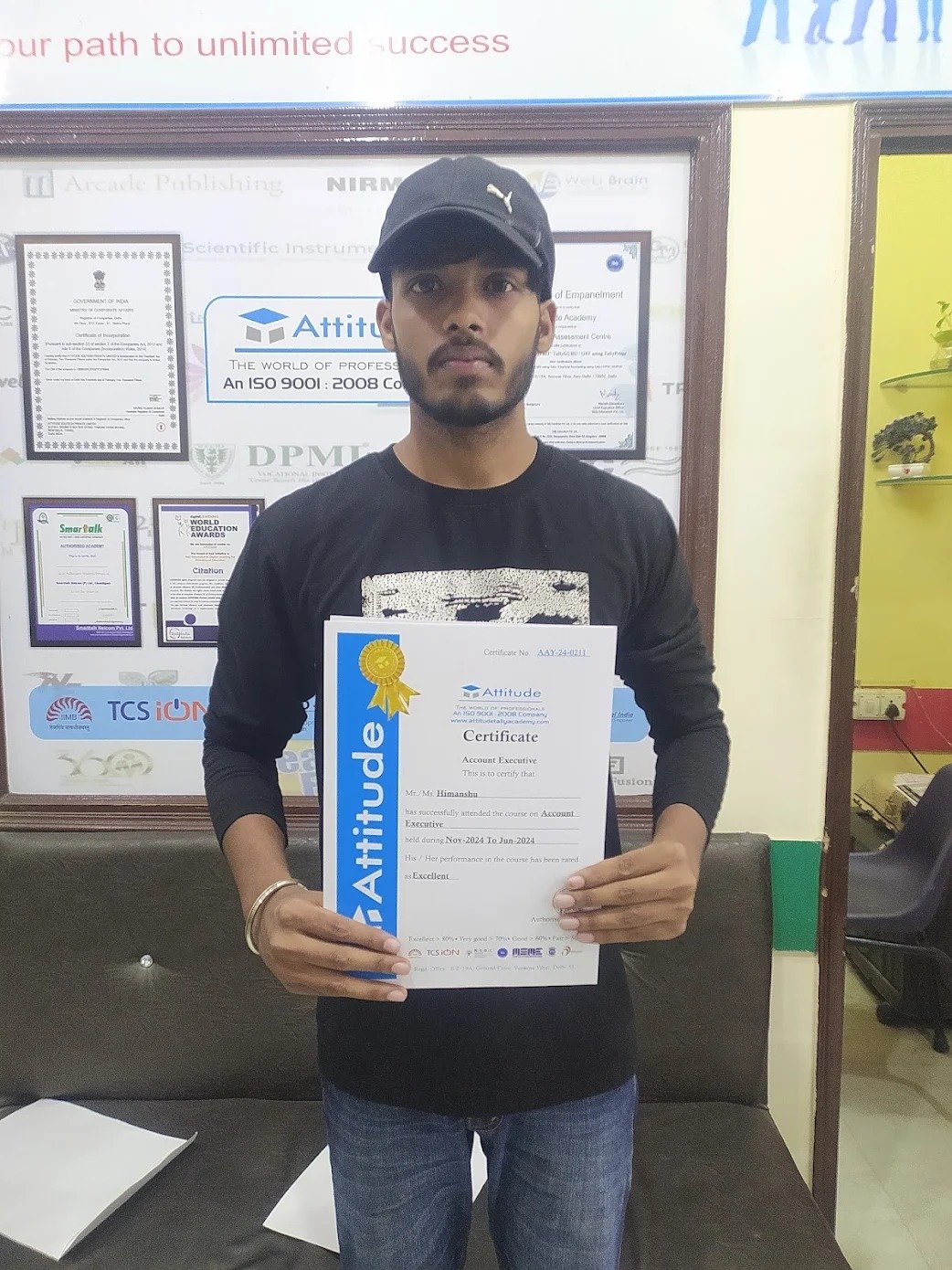

I enrolled in Attitude Academy’s e-accounting course, and it was a great decision! The course covers practical aspects of accounting software like Tally, GST, and taxation. The trainers are highly knowledgeable and provide hands-on support. Highly recommend it! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

I had an amazing experience at Attitude Academy’s e-accounting course. The trainers are experts in accounting software, and they break down even the most complex topics into easy-to-understand lessons. I now feel well-prepared for a career in accounting. Highly recommend! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

The e-accounting course at Attitude Academy was exactly what I needed! It covered everything from GST to managing financial statements. The trainers are knowledgeable, and the assignments gave me practical experience. I feel confident to take on any accounting role now. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

I have Completed my Tally.ERP9 Course with good experience. And now I feel that I am very confident about my interview and job.