Simple & Short Course to Learn TDS in Detail - A Complete Guide Course

Be able to operate a PC. That's all.

.jpg)

7 Days Money-Back Guarantee*

Take the final exam online to complete the Complete TDS with e-Filing after which you will be able to download your certificate from Attitude Trainings

Be able to operate a PC. That's all.

Watch the recorded & live videos to learn various concepts & get Live Sessions for Doubts Clearing

Test your knowledge through quizzes & module tests

Get hands on practice by doing assignments and project

Take the final exam to get certified in Complete TDS with e-Filing

Tax deduction and collection at source is the very important part of Income Tax. Every Accountant should have knowledge of TDS and TCS practical work. Basically this is a system introduced by Income Tax Department, where person responsible for making specified payments such as professional fees, commission, works contract, advertisement, interest, rent, salary, etc. is liable to deduct a certain percentage of tax before making payment.

In this course we have covered all the aspects of practical work as required for practical work. All the contents of this course are also a part of our Online Trianing Course. If you want to learn only TDS/TCS work you can enroll in this course.

PAN Application Complete Guide

TAN Application Complete Guide

TDS Return Form 26Q (TDS On Other Then Salary)

TDS Return Form 27Q (TDS On Other Then Salary NRI)

TDS Return Form 27EQ (TCS)

TDS & TCS Accounting Entries

Watch the recorded & live videos to learn various concepts & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests

Get hands on practice by doing assignments and project

Take the final exam to get certified in Complete TDS with e-Filing

You can post your doubts on the Q&A forum which will be answered by the teachers within 24 hours.

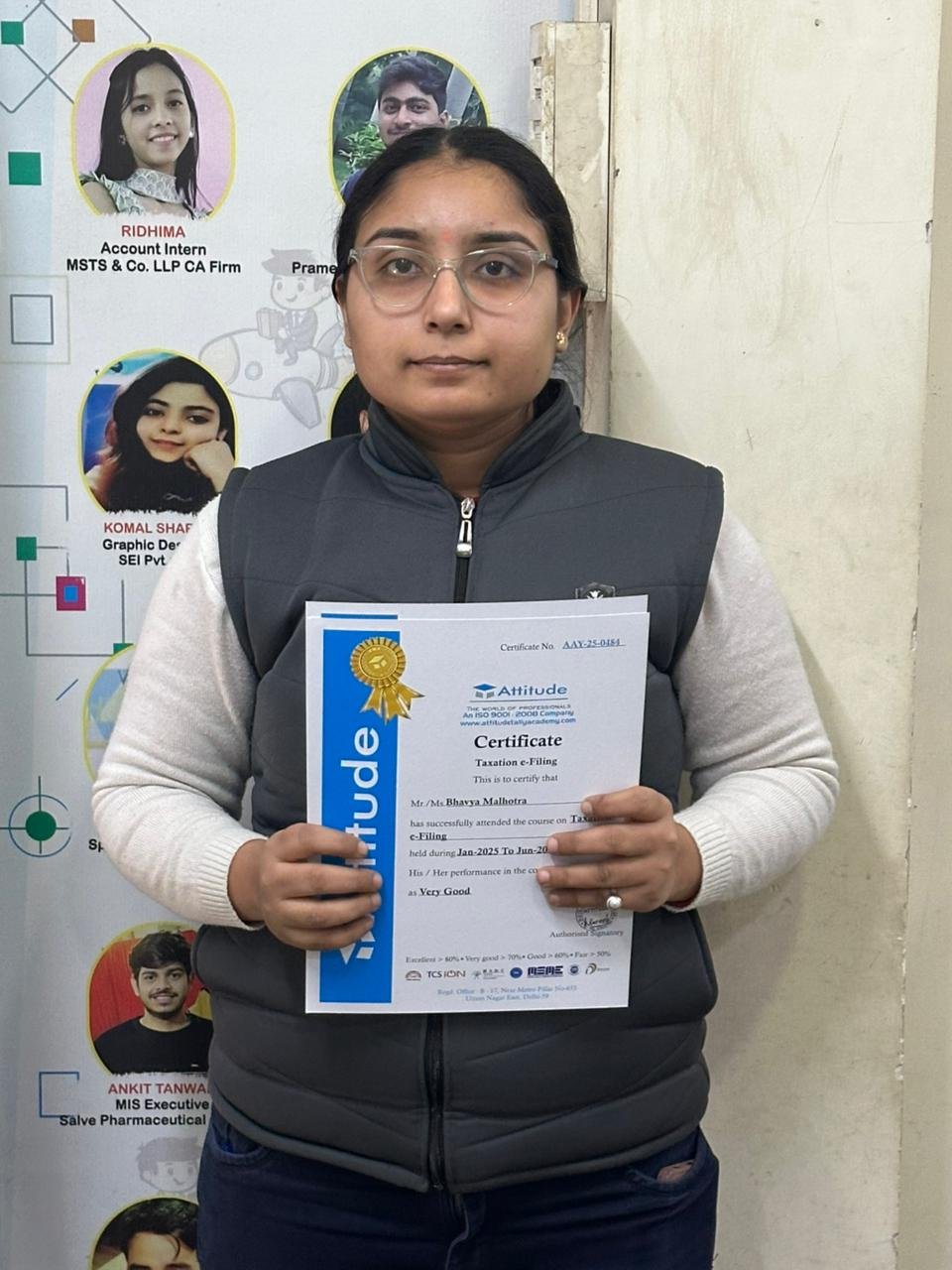

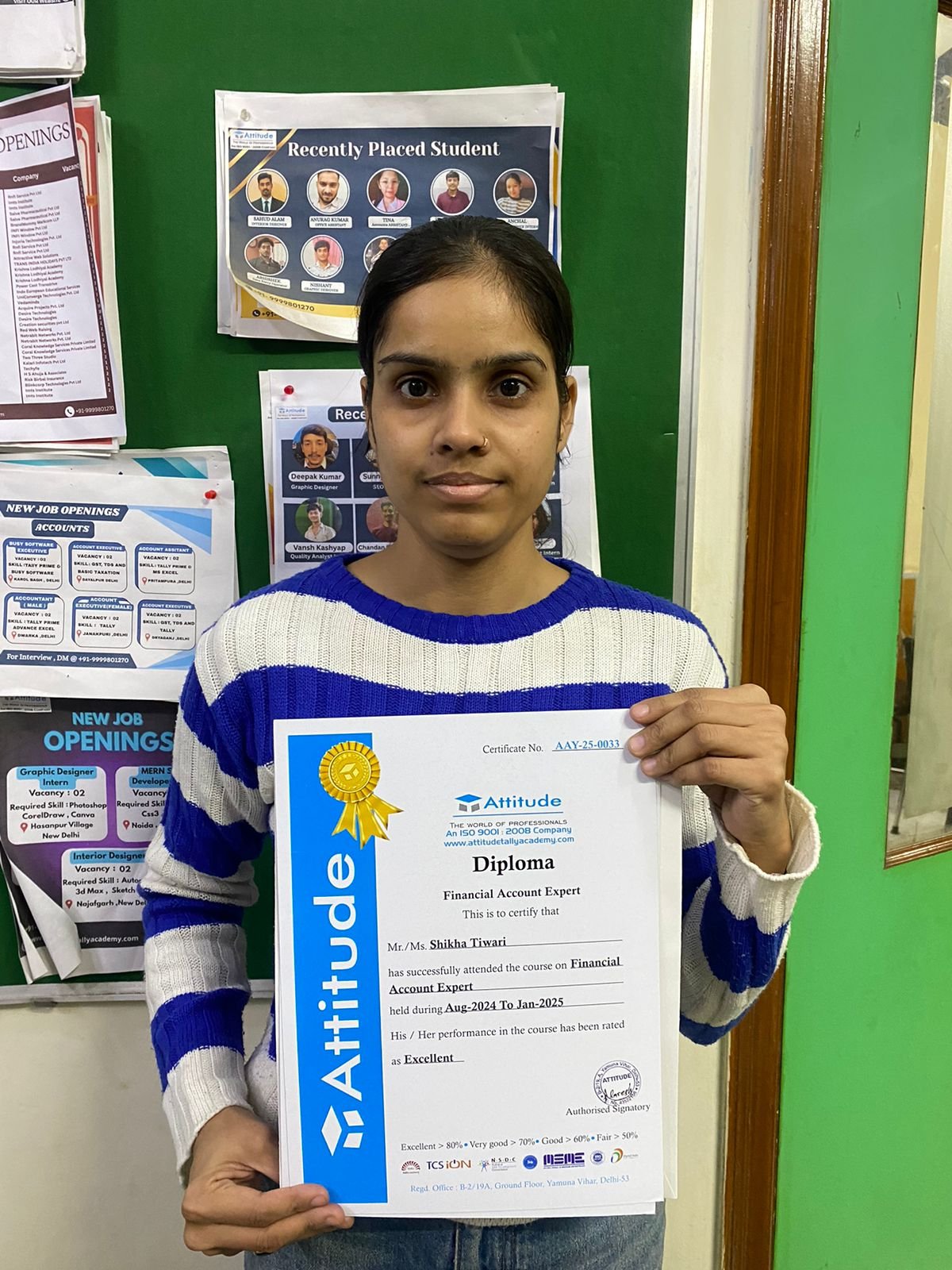

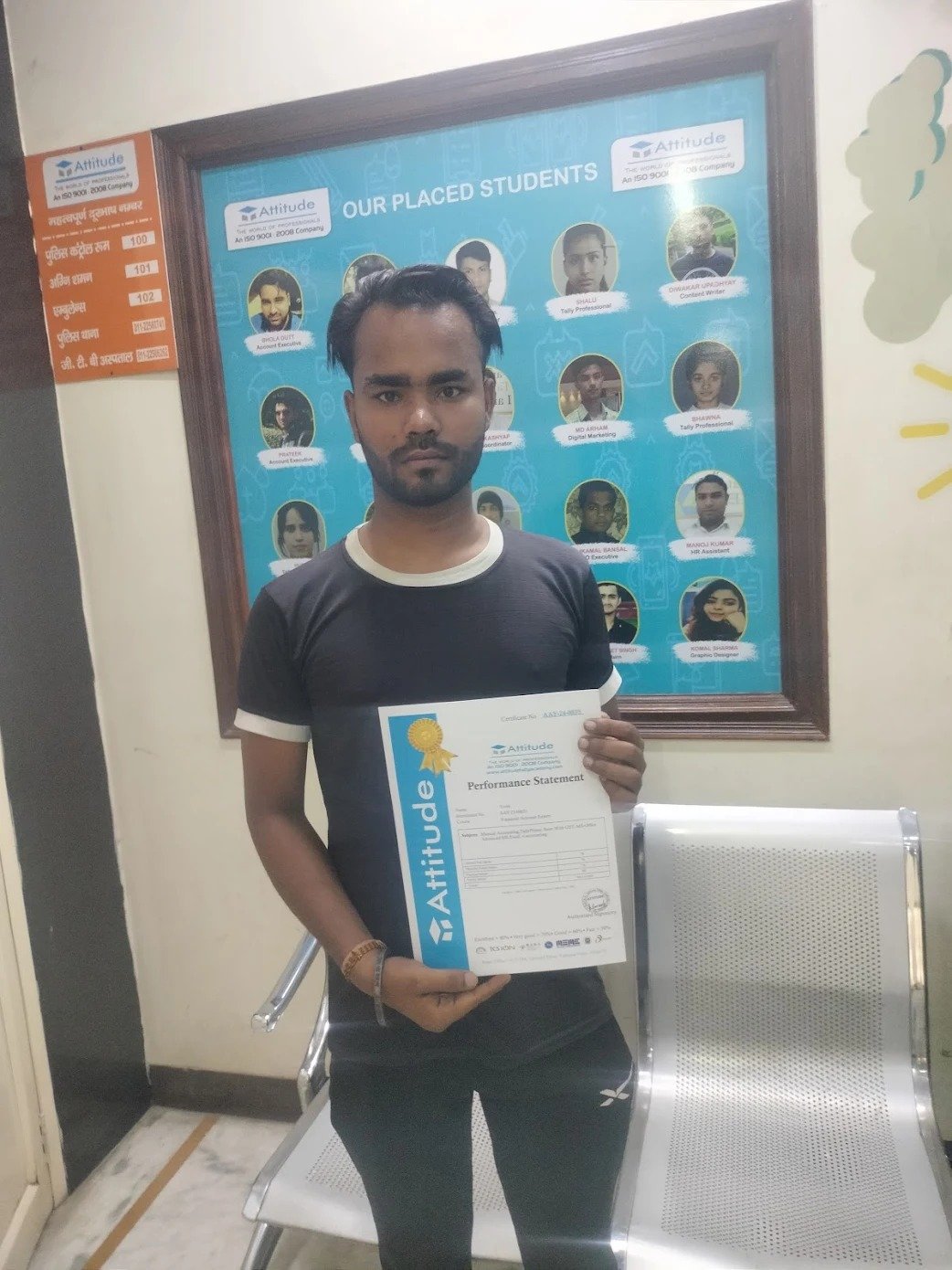

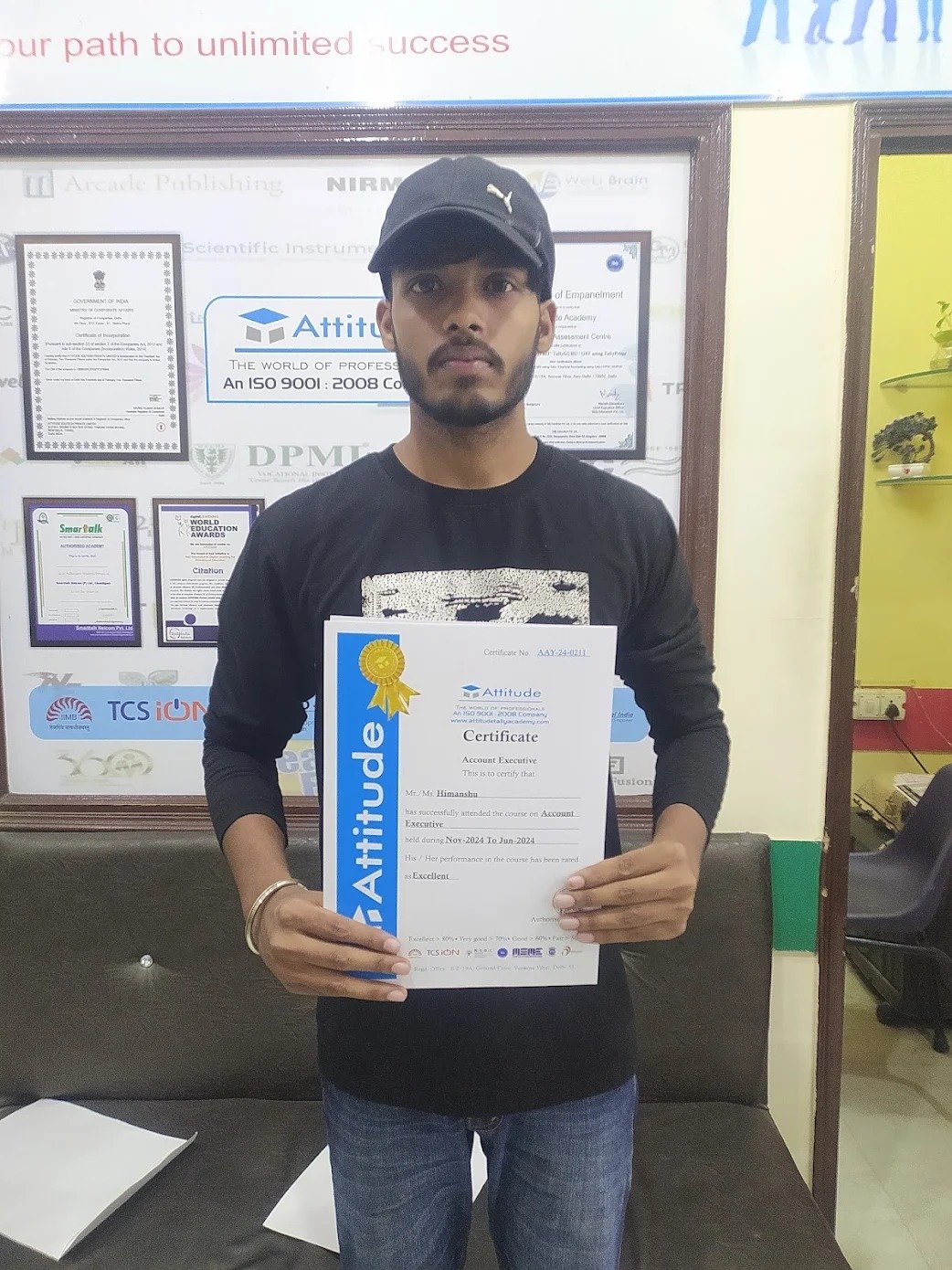

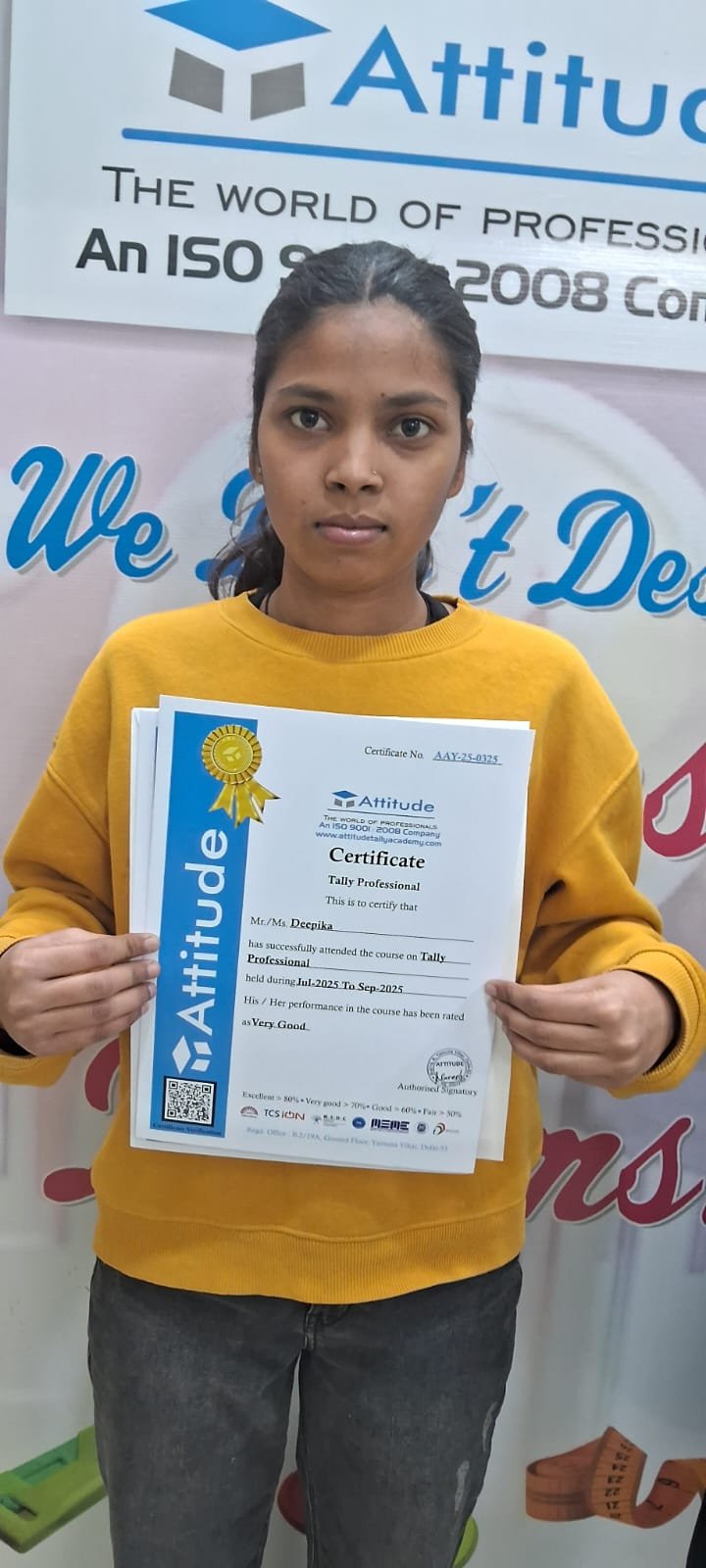

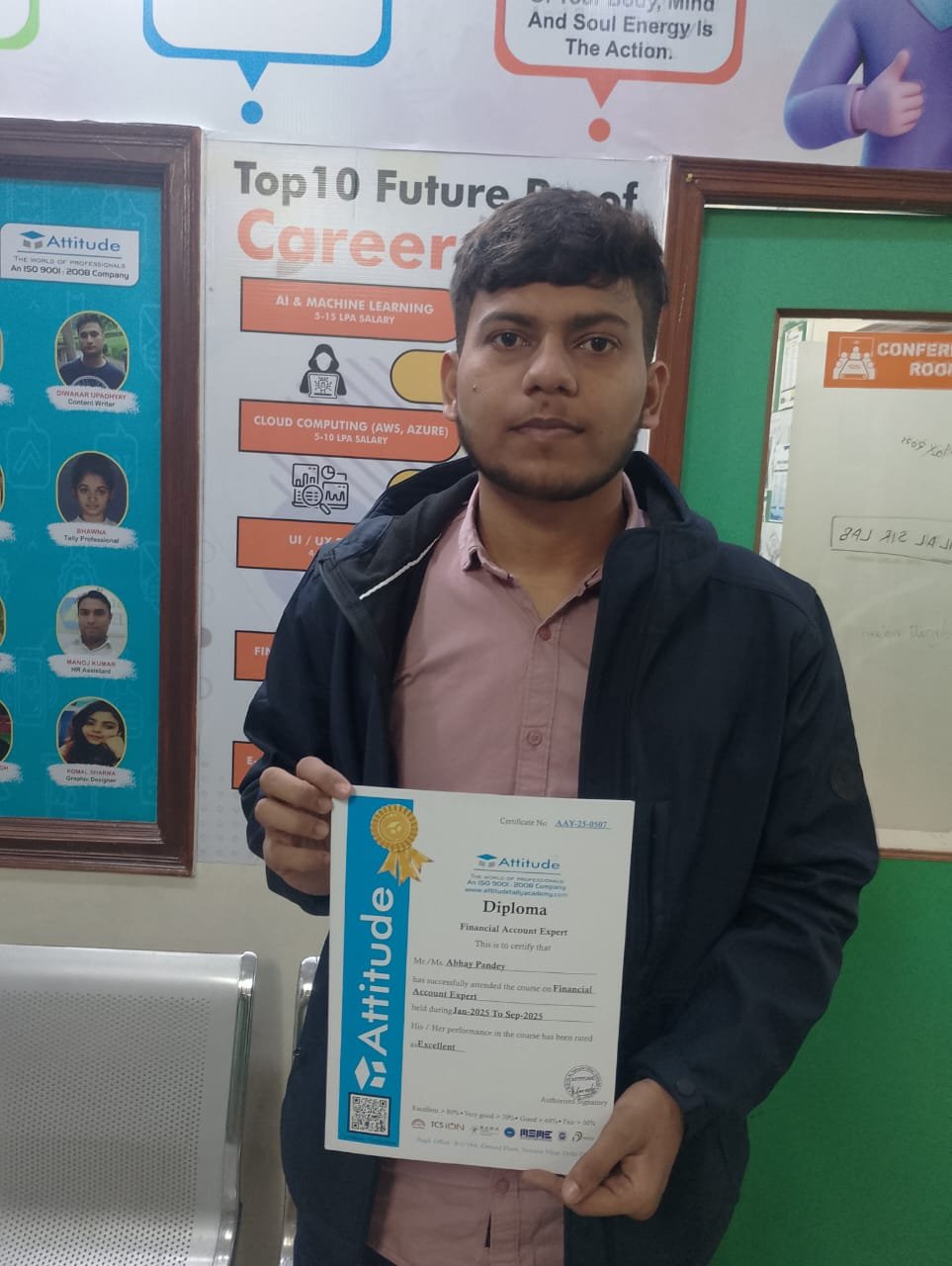

I enrolled in Attitude Academy’s e-accounting course, and it was a great decision! The course covers practical aspects of accounting software like Tally, GST, and taxation. The trainers are highly knowledgeable and provide hands-on support. Highly recommend it! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

I had an amazing experience at Attitude Academy’s e-accounting course. The trainers are experts in accounting software, and they break down even the most complex topics into easy-to-understand lessons. I now feel well-prepared for a career in accounting. Highly recommend! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

The e-accounting course at Attitude Academy was exactly what I needed! It covered everything from GST to managing financial statements. The trainers are knowledgeable, and the assignments gave me practical experience. I feel confident to take on any accounting role now. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

I have Completed my Tally.ERP9 Course with good experience. And now I feel that I am very confident about my interview and job.