Complete e Accounting tutorial from the very basics to the advanced concepts and adjustments

Be able to operate a PC. That's all.

.jpg)

.jpg)

7 Days Money-Back Guarantee*

Take the final exam online to complete the e Accounting From Beginner to Expert after which you will be able to download your certificate from Attitude Trainings

Be able to operate a PC. That's all.

Watch the recorded & live videos to learn various concepts & get Live Sessions for Doubts Clearing

Test your knowledge through quizzes & module tests

Get hands on practice by doing assignments and project

Take the final exam to get certified in e Accounting From Beginner to Expert

e Accounting is composition of two words E and Accounting. E means electronic in which every record is in electronic form and not on paper. In current time e Accounting plays an important role in every business organization of small and big scale in day to day life. In this electronic accounting system source documents and accounting records exist in digital form instead of on paper. It is an application of online and internet technologies to the business accounting function. e Accounting course is new development in area of accounting.

There has been remarkable growth in this era of information and communication technology in business to support the exchange of data and information within and between organizations. This concept is opted at international level. There is large number of companies who started e Accounting as a training programme. Attitude tally academy offers e Accounting course online and Offline to students and professionals. who wish to curtail their burden of recording transactions on paper

Introduction of 'e' Filing of Income

How To Register PAN,TAN

Tax Returns Generation of IT Form ITR 01

Tax Returns Generation of IT Form ITR 02

Tax Returns Generation of IT Form ITR 03

Tax Returns Generation of IT Form ITR 04

Tax Returns Generation of IT Form ITR 05

Tax Returns Generation of IT Form ITR06

E-Way Bill is an electronic way bill for movement of goods which can be generated on the e-Way Bill Portal. Transport of goods of more than Rs. 50,000 in value in a vehicle cannot be made by a registered person without an e-way bill. Alternatively, E-way bill can also be generated or cancelled through SMS, Android App and by Site-to-Site Integration (through API). When an e-way bill is generated a unique e-way bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

TCS(Tax Collected At Source) Entry

Challans Of TDS & TCS

Form of TDS & TCS

Reports of TDS & TCS

Watch the recorded & live videos to learn various concepts & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests

Get hands on practice by doing assignments and project

Take the final exam to get certified in e Accounting From Beginner to Expert

You can post your doubts on the Q&A forum which will be answered by the teachers within 24 hours.

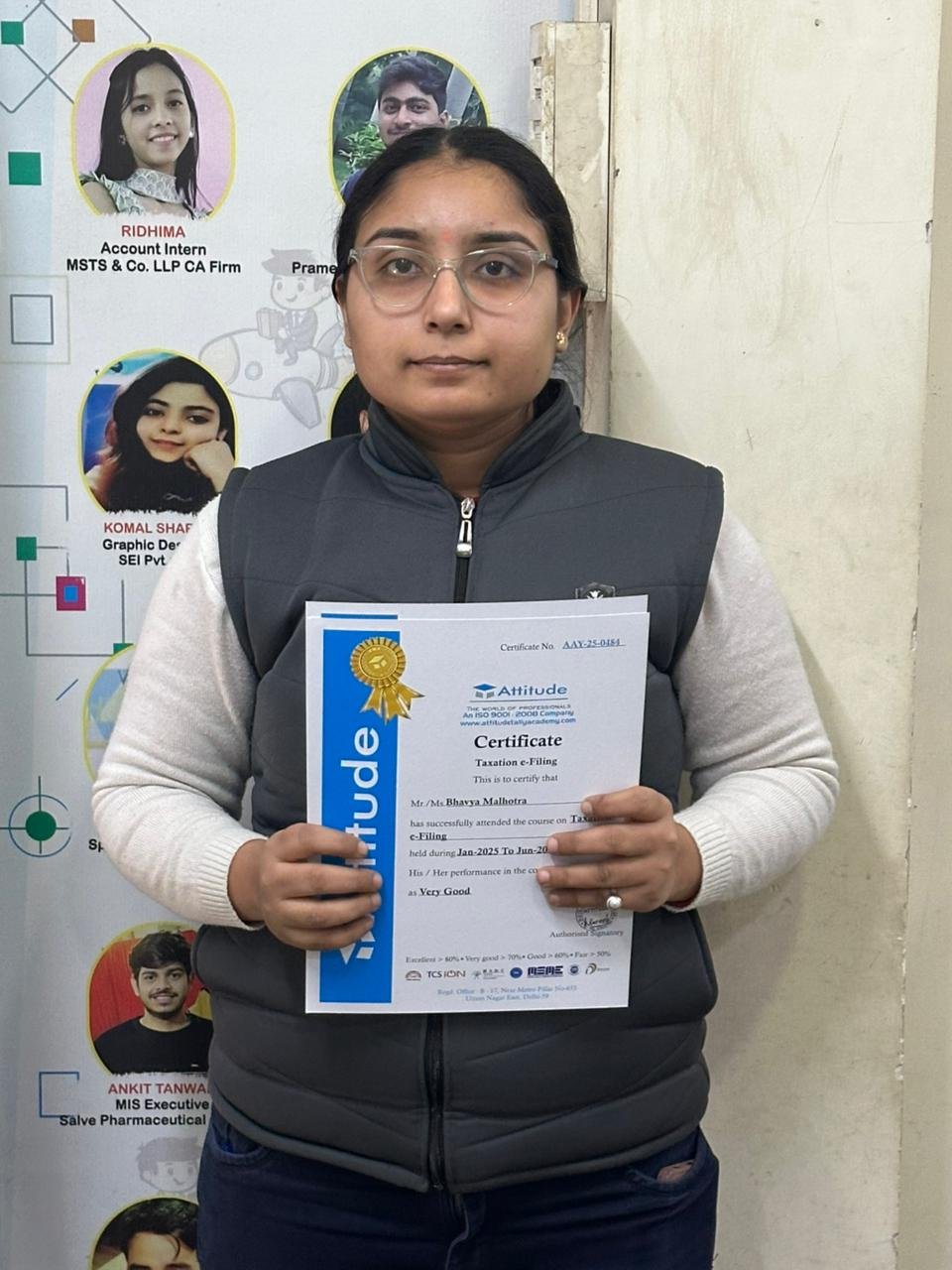

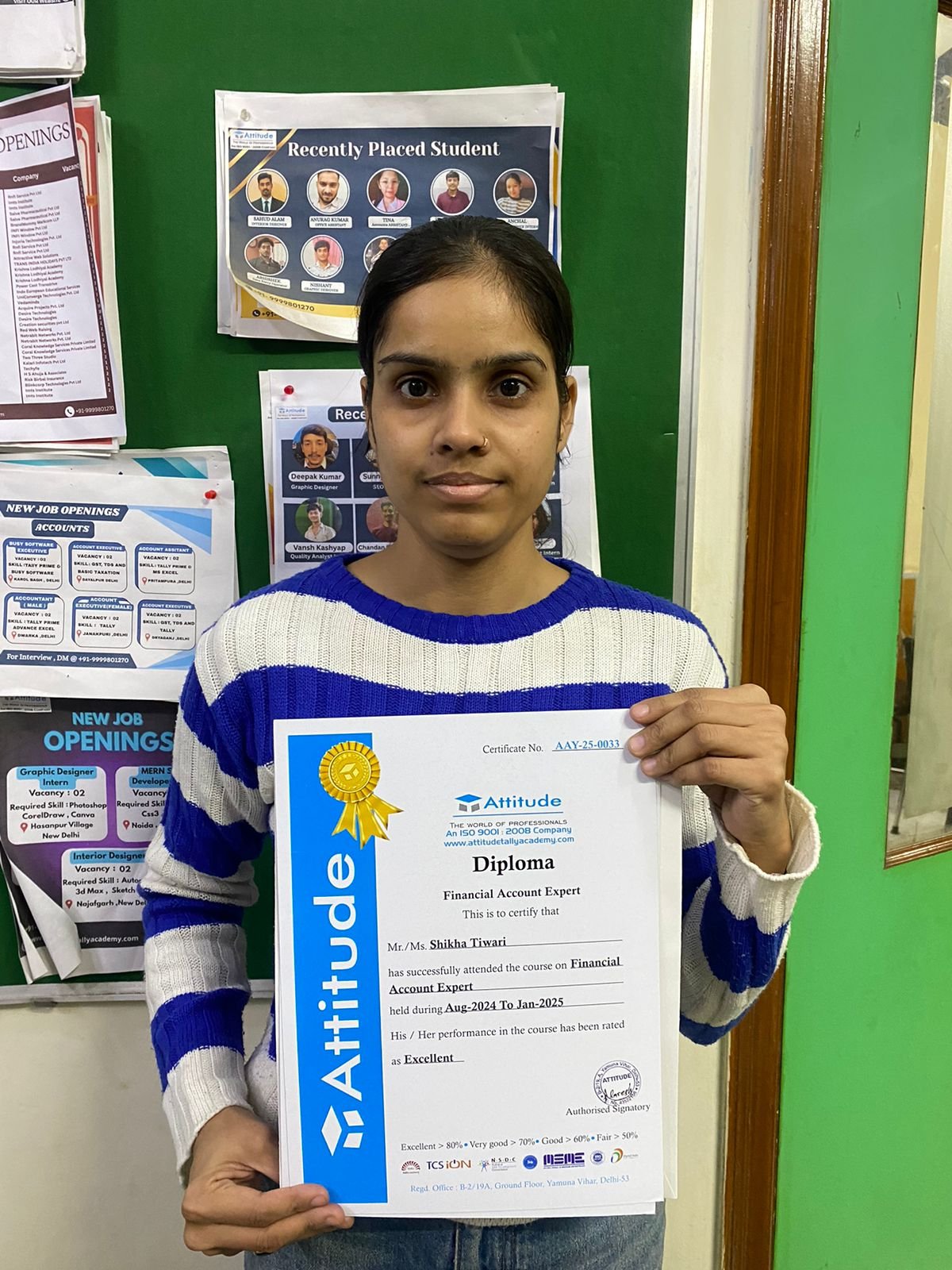

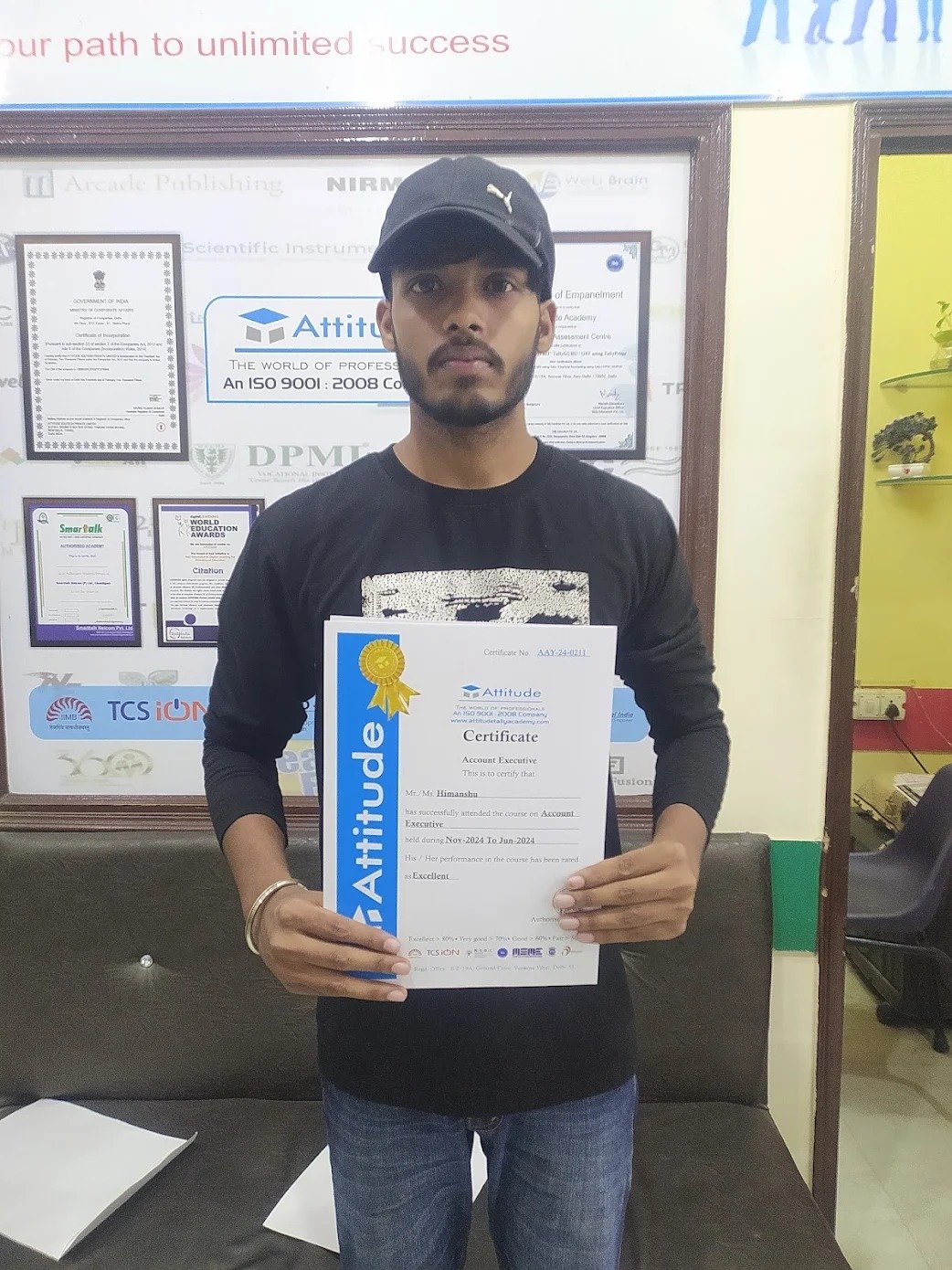

I enrolled in Attitude Academy’s e-accounting course, and it was a great decision! The course covers practical aspects of accounting software like Tally, GST, and taxation. The trainers are highly knowledgeable and provide hands-on support. Highly recommend it! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

I had an amazing experience at Attitude Academy’s e-accounting course. The trainers are experts in accounting software, and they break down even the most complex topics into easy-to-understand lessons. I now feel well-prepared for a career in accounting. Highly recommend! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

The e-accounting course at Attitude Academy was exactly what I needed! It covered everything from GST to managing financial statements. The trainers are knowledgeable, and the assignments gave me practical experience. I feel confident to take on any accounting role now. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

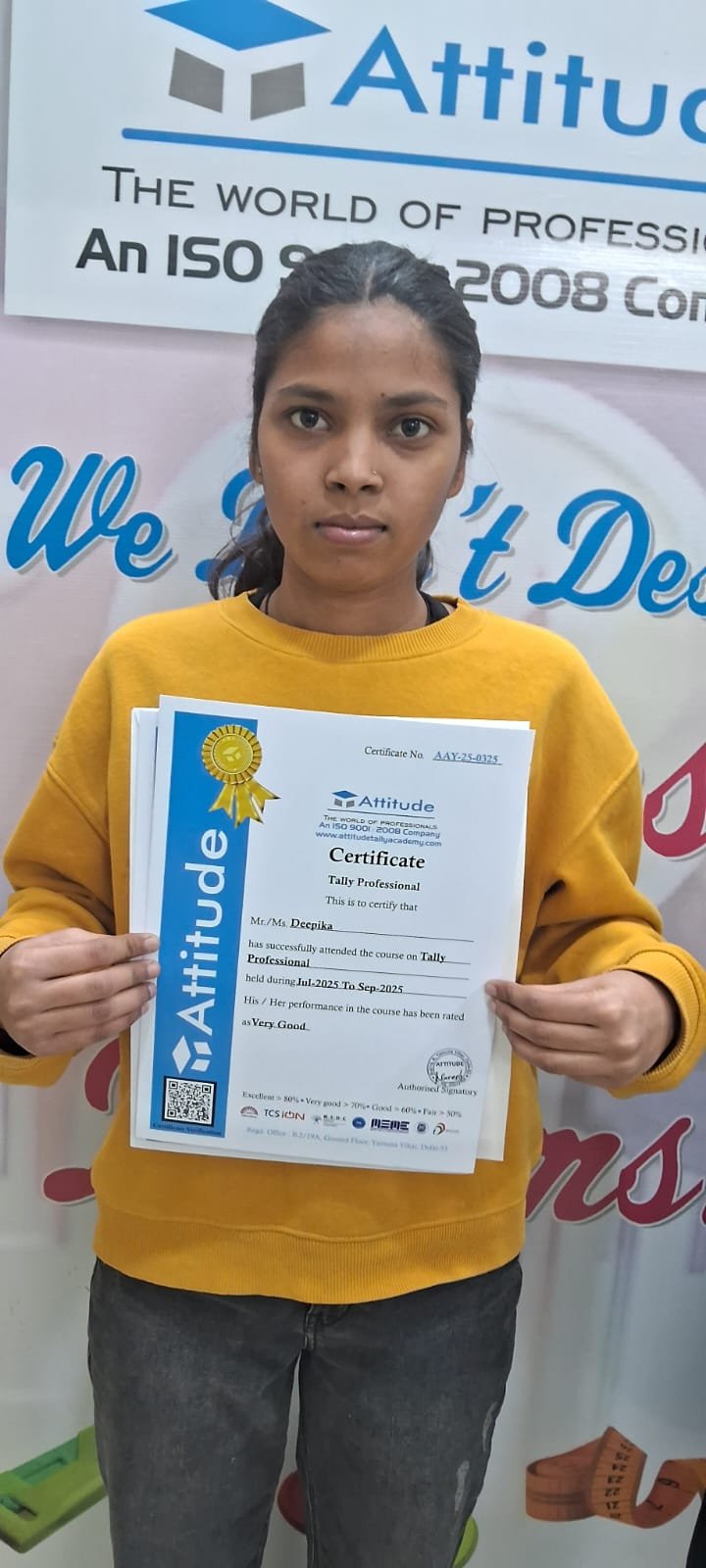

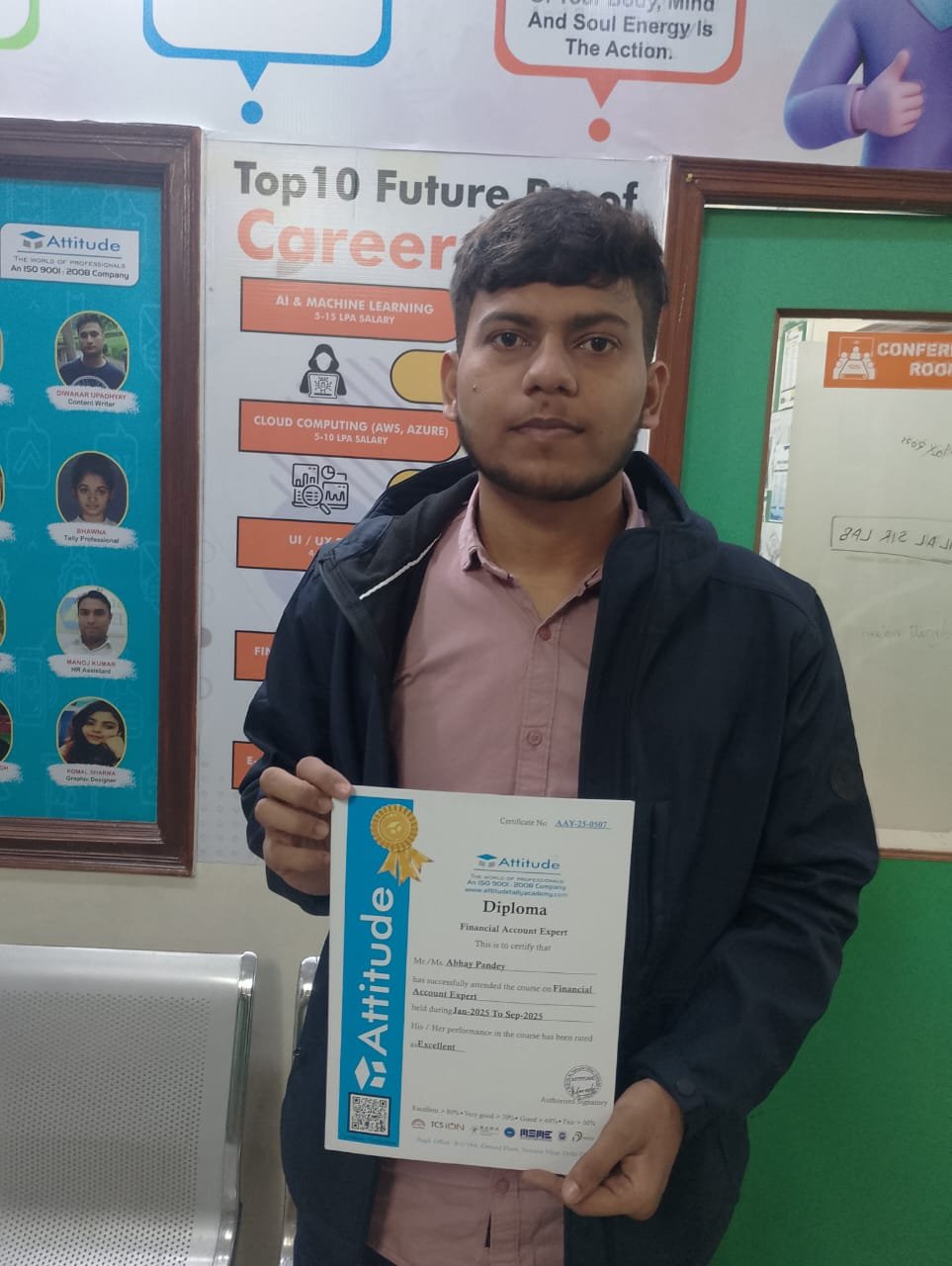

I have Completed my Tally.ERP9 Course with good experience. And now I feel that I am very confident about my interview and job.