Enter Your Details

Gain insight into Theoretical as well as Practical angle of GST from this course based Live Sessions & Recorded video.

Be able to operate a PC. That's all.

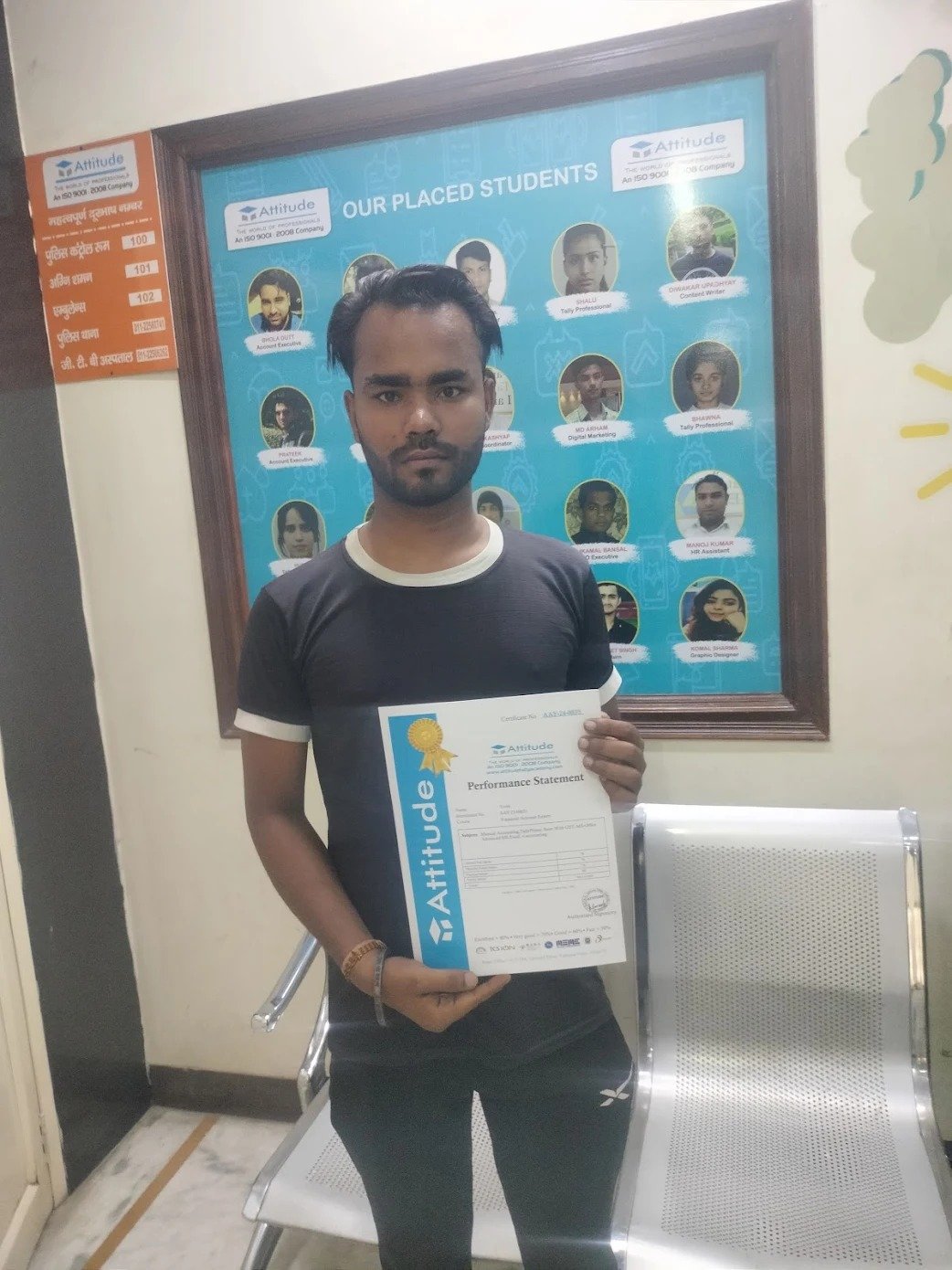

.jpg)

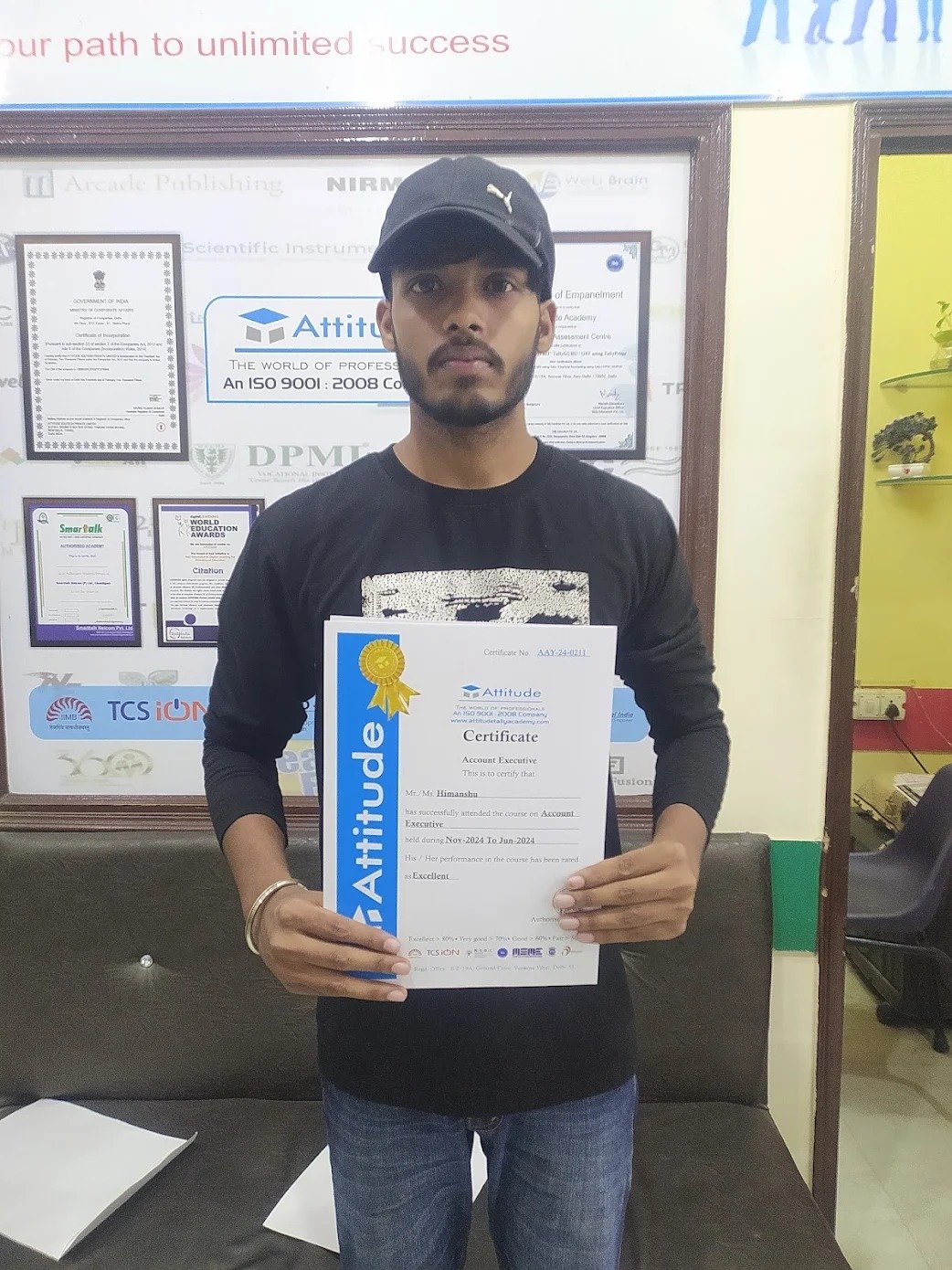

.jpg)

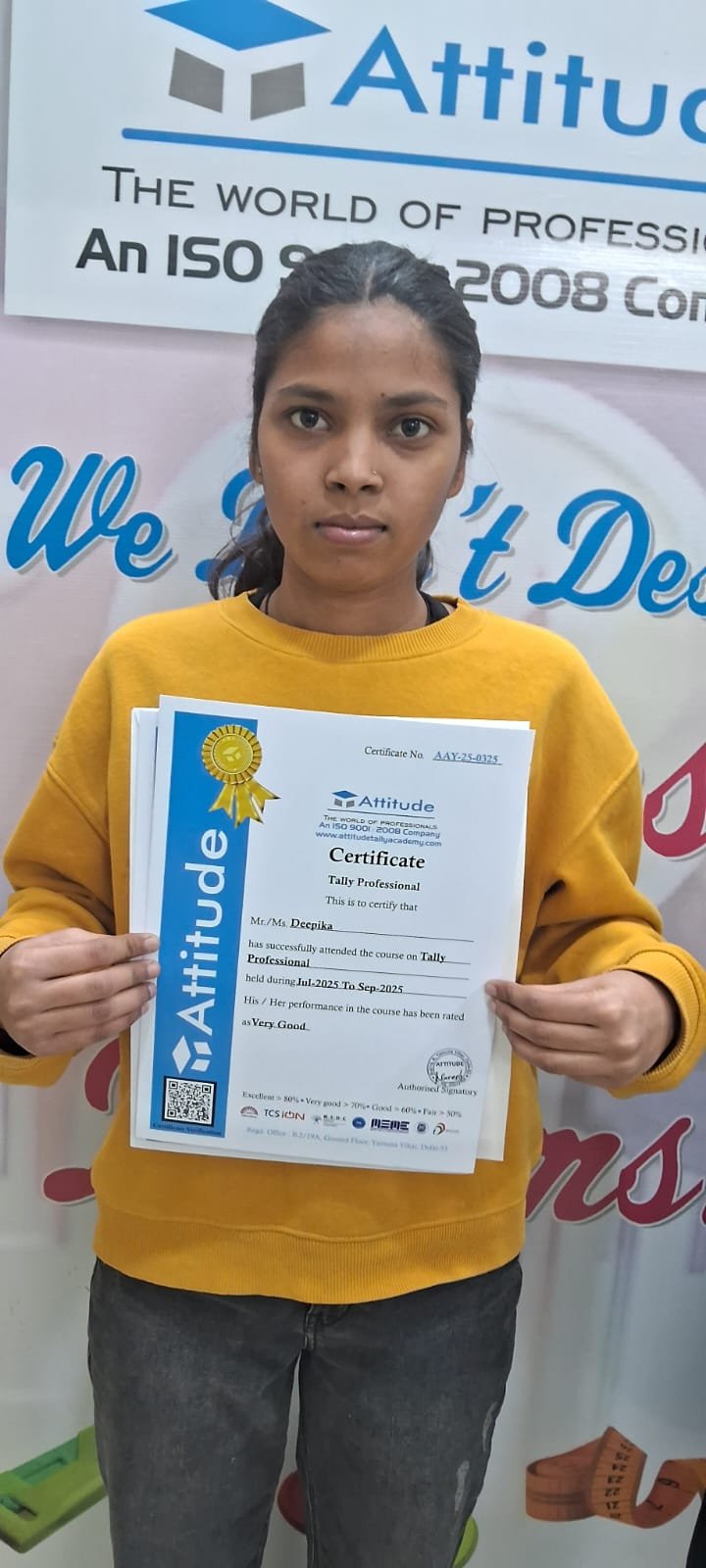

.jpg)

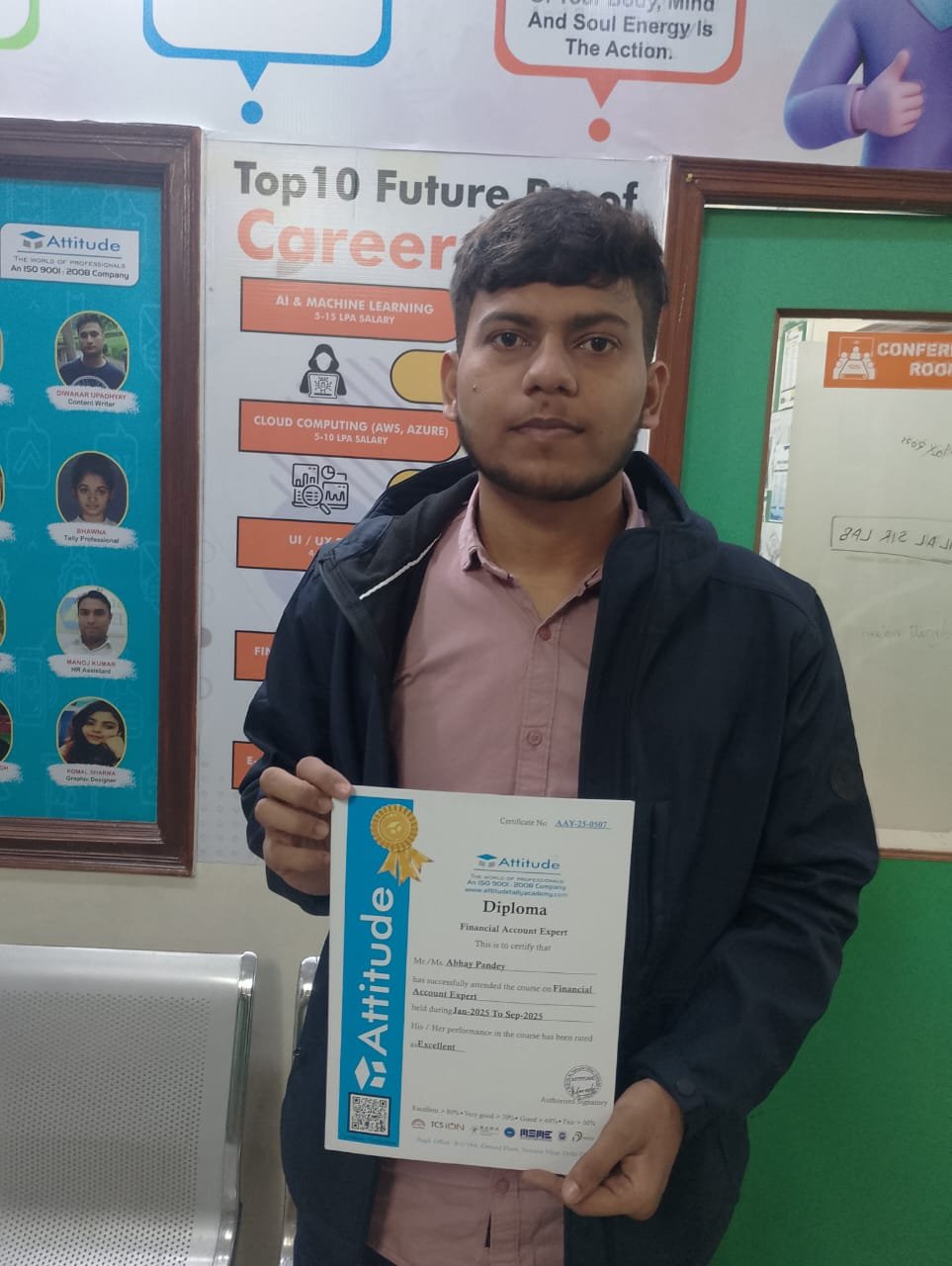

.jpg)

7 Days Money back Guarantee*

Take the final exam online to complete the Complete GST Course with e-Filing after which you will be able to download your certificate from Attitude Trainings

Be able to operate a PC. That's all.

Take all of your face to face classes with trainer & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests & offline assessment

Get hands on practice by doing assignments and project

Take the final exam to get certified in Complete GST Course with e-Filing

GST is known as Goods and Services Taxi and is proposed to be a comprehensive indirect tax implied on manufacture, sale and consumption of goods as well as services at the national level and Attitude Tally Academy has started a new GST course online & offline. Our institute Attitude Tally Academy is offering a GST course for the students who wish to pursue their career in the fields of accounts, here in Attitude Tally Academy Online classes of GST are provided under the leadership of highly qualified and experienced trainers. Our Excise Executive course help professionals to develop career with 100% job placement opportunity.

Important Definitions

Why GST is Necessary?

Impact of GST.

Benefits

Different Rates of GST.

FAQ

Different Place of Supply

Intra State Vs Inter State

FAQ

CGST

SGST

IGST

FAQ

B2B Concept

B2C Concept

Zero Rated Supply

FAQ

Types of Returns

Various Return Form

Return Process GSTR 1, GSTR 2, GSTR 3B

Return Process GSTR 2A, GSTR 9

FAQ

E-Way Bill is an electronic way bill for movement of goods which can be generated on the e-Way Bill Portal. Transport of goods of more than Rs. 50,000 in value in a vehicle cannot be made by a registered person without an e-way bill. Alternatively, E-way bill can also be generated or cancelled through SMS, Android App and by Site-to-Site Integration (through API). When an e-way bill is generated a unique e-way bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

GST is known as Goods and Services Taxi and is proposed to be a comprehensive indirect tax implied on manufacture, sale and consumption of goods as well as services at the national level and Attitude Tally Academy has started a new GST course online & offline. Our institute Attitude Tally Academy is offering a GST course for the students who wish to pursue their career in the fields of accounts, here in Attitude Tally Academy Online classes of GST are provided under the leadership of highly qualified and experienced trainers. Our Excise Executive course help professionals to develop career with 100% job placement opportunity.

Important Definitions

Why GST is Necessary?

Impact of GST.

Benefits

Different Rates of GST.

FAQ

Different Place of Supply

Intra State Vs Inter State

FAQ

CGST

SGST

IGST

FAQ

B2B Concept

B2C Concept

Zero Rated Supply

FAQ

Types of Returns

Various Return Form

Return Process GSTR 1, GSTR 2, GSTR 3B

Return Process GSTR 2A, GSTR 9

FAQ

E-Way Bill is an electronic way bill for movement of goods which can be generated on the e-Way Bill Portal. Transport of goods of more than Rs. 50,000 in value in a vehicle cannot be made by a registered person without an e-way bill. Alternatively, E-way bill can also be generated or cancelled through SMS, Android App and by Site-to-Site Integration (through API). When an e-way bill is generated a unique e-way bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

Take all of your face to face classes with trainer & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests & offline assessment

Get hands on practice by doing assignments and project

Take the final exam to get certified in Complete GST Course with e-Filing

Discover an exceptional opportunity at ATTITUDE Academy, where we introduce our meticulously crafted course designed to immerse participants in the foundational principles and standards of our esteemed GST with e-filing Training System. Conveniently situated in Uttam Nagar and Yamuna Vihar, Delhi, as an authorized GST with e-filing training center, we specialize in integrating GST with e-filing, providing comprehensive training with industry-standard tools.

Upon completion of our esteemed GST with e-filing course, individuals will possess indispensable skills crucial for excelling in Real-Time Industries. Our GST with e-filing classes in Yamuna Vihar and Uttam Nagar, Delhi, ensure 100% job support and continuous access to course materials. Enroll in our GST with e-filing program today to master essential IT skills.

Committed to empowering learners with vital expertise for a thriving career, ATTITUDE Academy stands as a premier GST with e-filing training institute in Uttam Nagar and Yamuna Vihar. We excel in delivering a comprehensive curriculum covering various facets of GST with e-filing education, preparing individuals for roles such as Data Entry and Accountant. Through interactive classes and innovative approaches, we foster an environment conducive to student development.

Our experienced instructors, with a proven track record of successfully training over 10,000 scholars, provide personalized guidance in live design training. Practical exposure is facilitated through internship opportunities, while collaborative learning environments thrive in discussion zones. Offering options for both regular and weekend classes, students benefit from scheduling flexibility, and our thorough interview preparation ensures they are well-prepared for a prosperous future in the realm of GST with e-filing technology.

You can post your doubts on the Q&A forum which will be answered by the teachers within 24 hours.

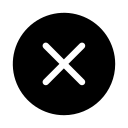

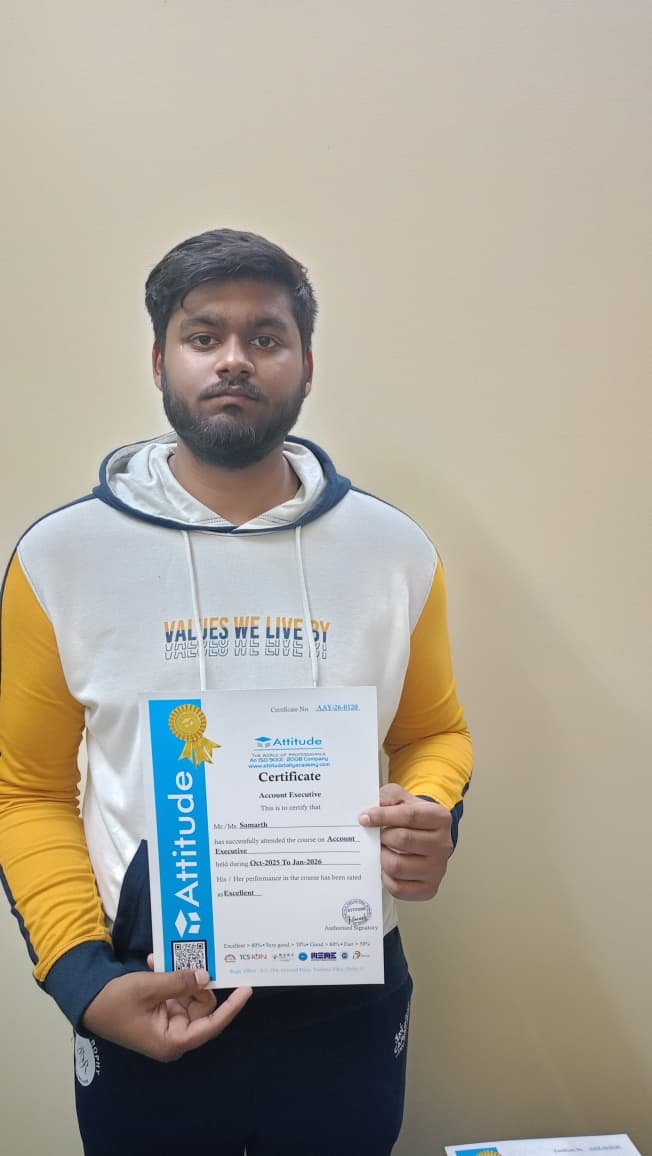

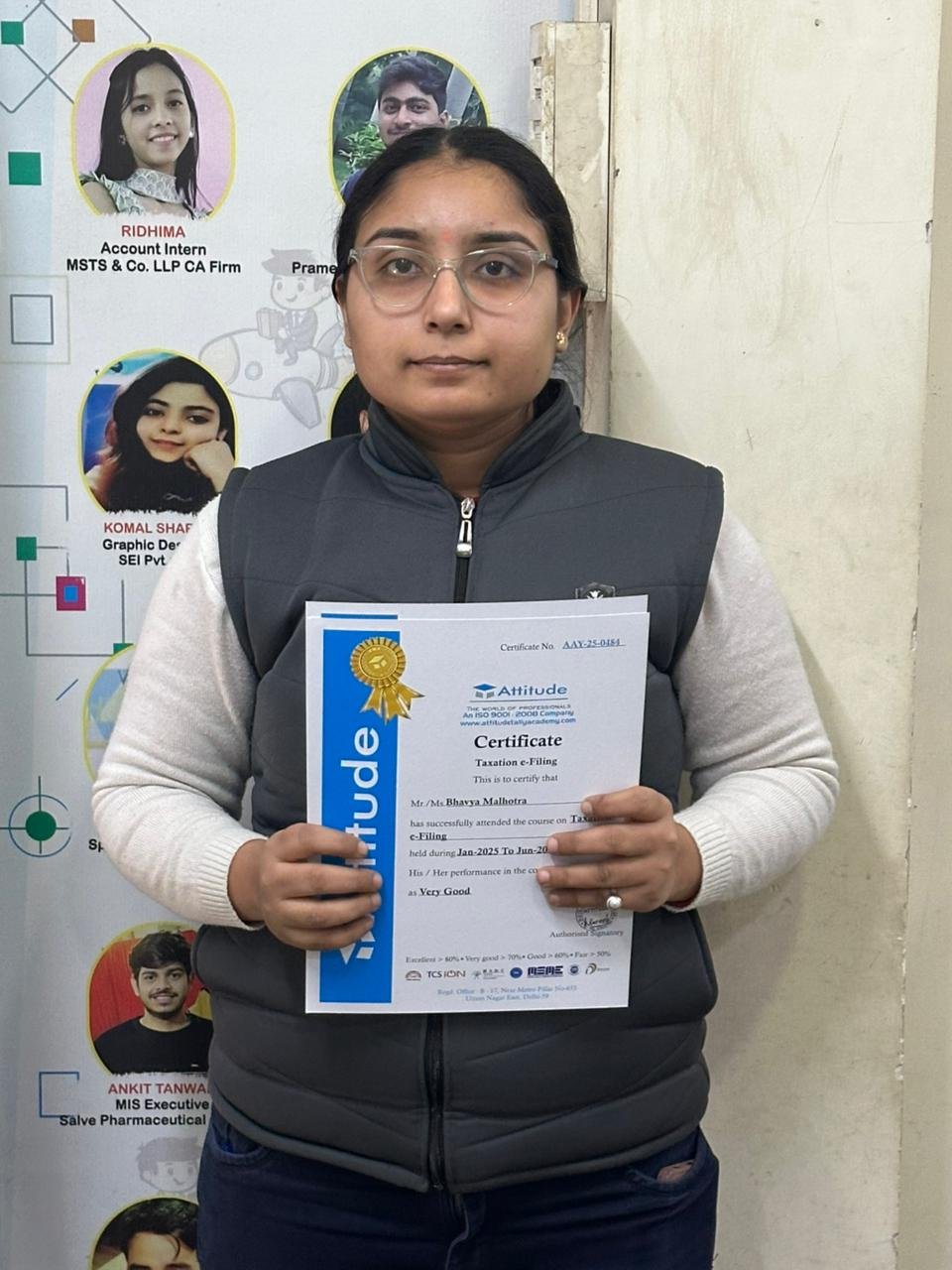

\"I had an amazing learning experience at Attitude Academy. The financial accounting course is top-notch, with experienced trainers who offer the best training. Their teaching methods are practical and easy to follow. I feel much more confident in my accounting skills now. Definitely the best training institute out there! ?\r\n\r\n\r\n\r\n

I enrolled in Attitude Academy’s e-accounting course, and it was a great decision! The course covers practical aspects of accounting software like Tally, GST, and taxation. The trainers are highly knowledgeable and provide hands-on support. Highly recommend it! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

I had an amazing experience at Attitude Academy’s e-accounting course. The trainers are experts in accounting software, and they break down even the most complex topics into easy-to-understand lessons. I now feel well-prepared for a career in accounting. Highly recommend! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

The e-accounting course at Attitude Academy was exactly what I needed! It covered everything from GST to managing financial statements. The trainers are knowledgeable, and the assignments gave me practical experience. I feel confident to take on any accounting role now. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

I have Completed my Tally.ERP9 Course with good experience. And now I feel that I am very confident about my interview and job.