Enter Your Details

Advanced Tally ERP9 Datailed Course

.jpg)

.jpg)

7 Days Money back Guarantee*

Take the final exam online to complete the Complete Tally ERP9 with GST after which you will be able to download your certificate from Attitude Trainings

Take all of your face to face classes with trainer & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests & offline assessment

Get hands on practice by doing assignments and project

Take the final exam to get certified in Complete Tally ERP9 with GST

Tally ERP 9 provides a comprehensive solution to the accounting and inventory needs of a business. The package comprises GST (goods and services tax), financial accounting, Book-keeping and inventory accounting. Tally is popularly known as an accounting software for small and medium businesses. It does all the functions of accounting that a particularly mid sized business has.

Fundamentals of Tally.ERP 9

Create Accounting Masters in Tally.ERP 9

Accounting Vouchers

Financial Statements and Accounting Books & Reports

Inventory Vouchers

Generating Inventory Books & Reports

Technological Advantages of Tally.ERP

Tally.NET and Remote Capabilities

Application Management

Online Help and Support

Cost Centres and Cost Categories

Voucher Classes

Multiple Currencies

Interest Calculations

Budget & Controls

Scenario Management

Banking

Multiple Price Level

Tracking Numbers

Batch – wise Details

Additional Cost Details

Bill of Materials (BoM)

Price Levels and Price Lists

Stock Valuation

Zero Valued Entries

Inventory Analysis

Different Actual and Billed Quantities

Job Costing

Job Order Processing

Activating GST for Your Company

Setting Up GST Rates

Updating Stock Items and Stock Groups for GST Compliance

Updating a Service Ledger for GST Compliance

Updating Sales and Purchase Ledgers for GST Compliance

Updating Party GSTIN.

Creating GST Ledgers

Creating Income and Expense Ledgers

Recording Sales and Printing Invoices

Recording Purchases

Recording a Tax Payment

Other Scenarios

Sales - Nil Rated, Exempt, SEZ, and Deemed Export

Recording Sales Returns

Recording Purchase Returns

Recording an Advance Receipt from Customer

Recording an Advance Payment to Supplier

Recording Journal Vouchers for Adjustments Against Tax Credit

GSTR-1, GSTR-2A, GSTR-2, GSTR-3B

Returns Summary

Particulars (Computation Details)

Summary of Exceptions

Table-wise GSTR-1, GSTR-2A, GSTR-2, GSTR-3B

Status Reconciliation

Exporting GSTR-1, GSTR-2A, GSTR-2, GSTR-3B

Challan Reconciliation

TCS(Tax Collected At Source) Entry

Challans Of TDS & TCS

Form of TDS & TCS

Reports of TDS & TCS

Tally ERP 9 provides a comprehensive solution to the accounting and inventory needs of a business. The package comprises GST (goods and services tax), financial accounting, Book-keeping and inventory accounting. Tally is popularly known as an accounting software for small and medium businesses. It does all the functions of accounting that a particularly mid sized business has.

Fundamentals of Tally.ERP 9

Create Accounting Masters in Tally.ERP 9

Accounting Vouchers

Financial Statements and Accounting Books & Reports

Inventory Vouchers

Generating Inventory Books & Reports

Technological Advantages of Tally.ERP

Tally.NET and Remote Capabilities

Application Management

Online Help and Support

Cost Centres and Cost Categories

Voucher Classes

Multiple Currencies

Interest Calculations

Budget & Controls

Scenario Management

Banking

Multiple Price Level

Tracking Numbers

Batch – wise Details

Additional Cost Details

Bill of Materials (BoM)

Price Levels and Price Lists

Stock Valuation

Zero Valued Entries

Inventory Analysis

Different Actual and Billed Quantities

Job Costing

Job Order Processing

Activating GST for Your Company

Setting Up GST Rates

Updating Stock Items and Stock Groups for GST Compliance

Updating a Service Ledger for GST Compliance

Updating Sales and Purchase Ledgers for GST Compliance

Updating Party GSTIN.

Creating GST Ledgers

Creating Income and Expense Ledgers

Recording Sales and Printing Invoices

Recording Purchases

Recording a Tax Payment

Other Scenarios

Sales - Nil Rated, Exempt, SEZ, and Deemed Export

Recording Sales Returns

Recording Purchase Returns

Recording an Advance Receipt from Customer

Recording an Advance Payment to Supplier

Recording Journal Vouchers for Adjustments Against Tax Credit

GSTR-1, GSTR-2A, GSTR-2, GSTR-3B

Returns Summary

Particulars (Computation Details)

Summary of Exceptions

Table-wise GSTR-1, GSTR-2A, GSTR-2, GSTR-3B

Status Reconciliation

Exporting GSTR-1, GSTR-2A, GSTR-2, GSTR-3B

Challan Reconciliation

TCS(Tax Collected At Source) Entry

Challans Of TDS & TCS

Form of TDS & TCS

Reports of TDS & TCS

Take all of your face to face classes with trainer & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests & offline assessment

Get hands on practice by doing assignments and project

Take the final exam to get certified in Complete Tally ERP9 with GST

Discover an exceptional opportunity at ATTITUDE Academy, where we present our meticulously crafted course designed to immerse participants in the foundational principles and standards of our esteemed Tally ERP 9 with GST Training System. Conveniently situated in Uttam Nagar and Yamuna Vihar, Delhi, as an authorized Tally ERP 9 with GST training center, we specialize in integrating Tally ERP 9 with GST, providing comprehensive training with industry-standard tools.

Upon completion of our esteemed Tally ERP 9 with GST course, individuals will possess indispensable skills crucial for excelling in Real-Time Industries. Our Tally ERP 9 with GST classes in Yamuna Vihar and Uttam Nagar, Delhi, ensure 100% job support and continuous access to course materials. Enroll in our Tally ERP 9 with GST program today to master essential IT skills.

Committed to empowering learners with vital expertise for a thriving career, ATTITUDE Academy stands as a premier Tally ERP 9 with GST training institute in Uttam Nagar and Yamuna Vihar. We excel in delivering a comprehensive curriculum covering various facets of Tally ERP 9 with GST education, preparing individuals for roles such as Data Entry and Accountant. Through interactive classes and innovative approaches, we cultivate an environment conducive to student development.

Our experienced instructors, with a proven track record of successfully training over 10,000 scholars, provide personalized guidance in live design training. Practical exposure is facilitated through internship opportunities, while collaborative learning environments thrive in discussion zones. Offering options for both regular and weekend classes, students benefit from scheduling flexibility, and our thorough interview preparation ensures they are well-prepared for a prosperous future in the realm of Tally ERP 9 with GST technology.

You can post your doubts on the Q&A forum which will be answered by the teachers within 24 hours.

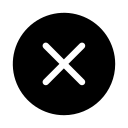

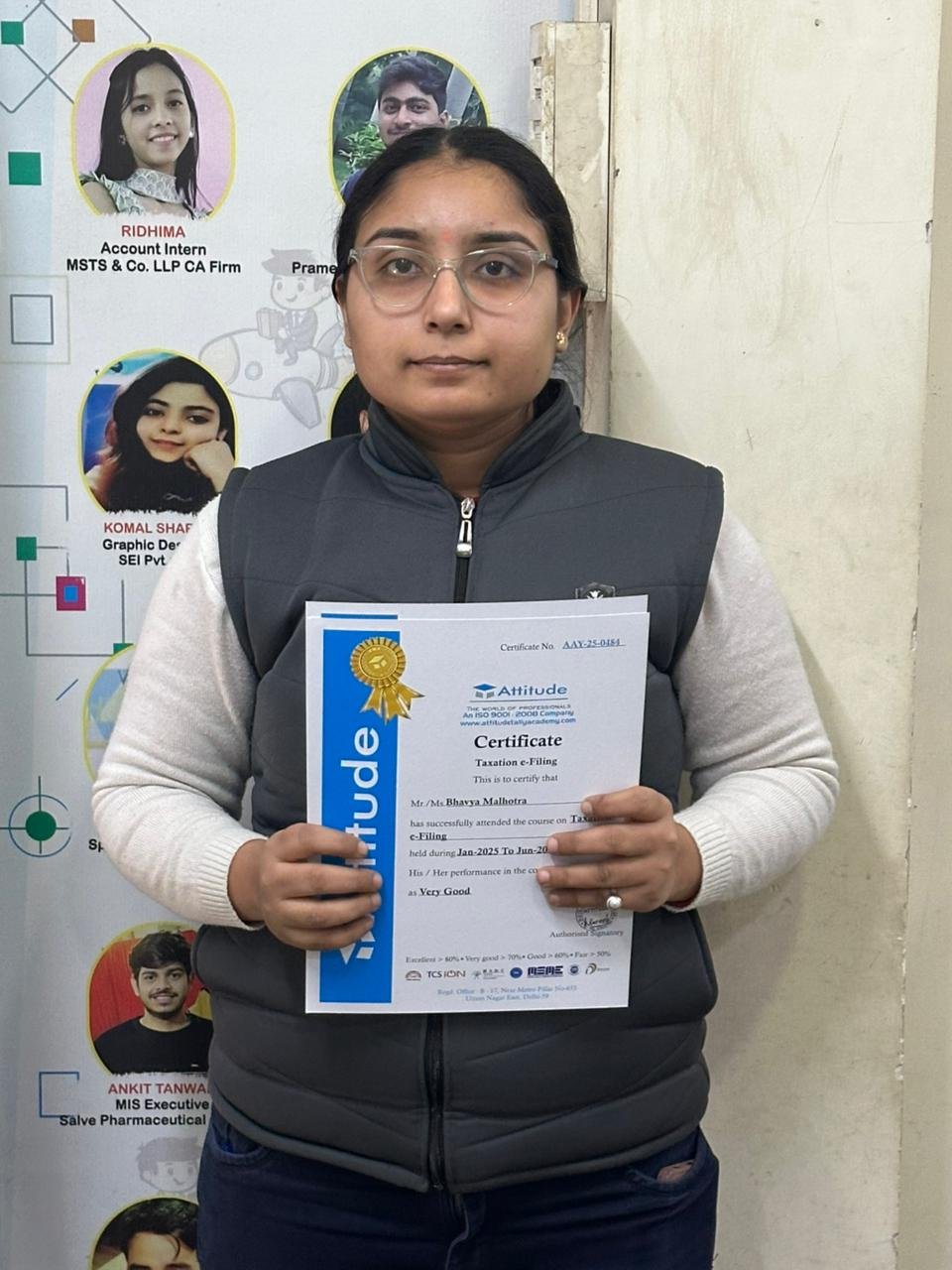

I enrolled in Attitude Academy’s e-accounting course, and it was a great decision! The course covers practical aspects of accounting software like Tally, GST, and taxation. The trainers are highly knowledgeable and provide hands-on support. Highly recommend it! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

I had an amazing experience at Attitude Academy’s e-accounting course. The trainers are experts in accounting software, and they break down even the most complex topics into easy-to-understand lessons. I now feel well-prepared for a career in accounting. Highly recommend! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

Attitude Academy’s e-accounting course in yamuna vihar helped me gain a solid understanding of accounting concepts. The course covered everything from accounting software to GST filing. The trainers made the entire process simple and engaging. Highly recommend for anyone wanting to improve their accounting skills! ??

The e-accounting course at Attitude Academy was exactly what I needed! It covered everything from GST to managing financial statements. The trainers are knowledgeable, and the assignments gave me practical experience. I feel confident to take on any accounting role now. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

The e-accounting course at Attitude Academy is incredible! The course is well-structured, and the trainers are very supportive. I learned everything from GST filing to digital accounting software like Tally and QuickBooks. This course gave me the practical skills I needed. Highly recommend! ??

I have Completed my Tally.ERP9 Course with good experience. And now I feel that I am very confident about my interview and job.