Previously, on Friday 1st Feb, the Union Finance Minister Piyush Goyal presented the Interim Budget for the year 2019 in the Parliament. The interim budget that was talked about today usually does not feature any new schemes. It is just the interim and not the full-fledged budget which will be presented after the general election.

First check out our described video on UNION BUDGET 2019:

Meanwhile Attitude Tally Academy gives you the interim budget 2019 highlights to feed upon:

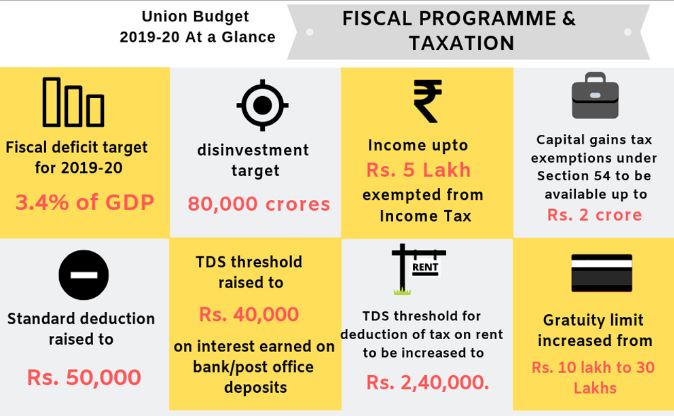

Tax related reliefs:

• If taxable income is less than Rs 5 lakh, no tax for those

• For salaried class the standard deduction increased from Rs 40,000 to Rs 50,000

• The IT returns will now be processed within 24 hours and all refunds will be paid immediately

For Farmers:

• For small and marginal farmers there will be Rs 6,000 per year assured income support

• Kamdhenu scheme for animal husbandry

• Interest subvention of 2% to farmers who pursue fisheries jobs and animal husbandry through Kisaan credit cards.

• Farmers to get Rs 6,000 per year in three equal instalment those who have up to 2 hectare of lands

GST:

• Ways will be suggested by Group of Ministers to reduce GST for house buyers

• In January 2019 GST collections has crossed Rs 1 lakh crore

• Businesses those who have less than less than Rs 5 crore annual turnover, comprising over 90% of GST payers, will now be allowed to file quarterly returns.

• Duty abolished on 36 capital goods

Here is an infographic of few highlighted points:

Other Highlights Include:

• Semi high-speed train, Vande Bharat Express to be launched

• One lakh digital villages for next five years

• Fund allocation increased to Rs. 58,166 crore to the Northeast region for infrastructure development. It is a 21% rise over last year.

• In Indian Cinematograph Act Anti-camcord regulations to be introduced in order to prevent piracy

• National Artificial Intelligence (NIA) portal will be developed soon

• Minimum pension increased to Rs. 1000 and ESI cover limit also increased to Rs. 21,000.

• MSME will source 25 percent for government projects, out of which 3 percent will be from women entrepreneurs.

• For workers of india from the organised sector with an income of less than Rs. 15,000, Mega pension scheme called PM Shramyogi Maan Dhan Yojana will be there. After 60 years of age they will be able to earn Rs. 3000.

• In Haryana the 22nd AIIMS will come up.

• TDS threshold raised from Rs. 10,000 to Rs. 40,000 on interest on post office and bank deposits

• Increased allocation to 750 crore in the current year for Rashtriya Gokul Mission

• Defence budget got increased to over Rs 3 lakh crore. If needed additional funds will be provided

• 35,000 crore rupees are disbursed over last few years under #OROP scheme

These are just few budget highlights presented to you by Attitude Financial e-Accounting Academy of Yamuna Vihar delhi. Start planning your financial year accordingly.