Coffee, Calculations & Chill: Your Friendly Guide to e-Accounting

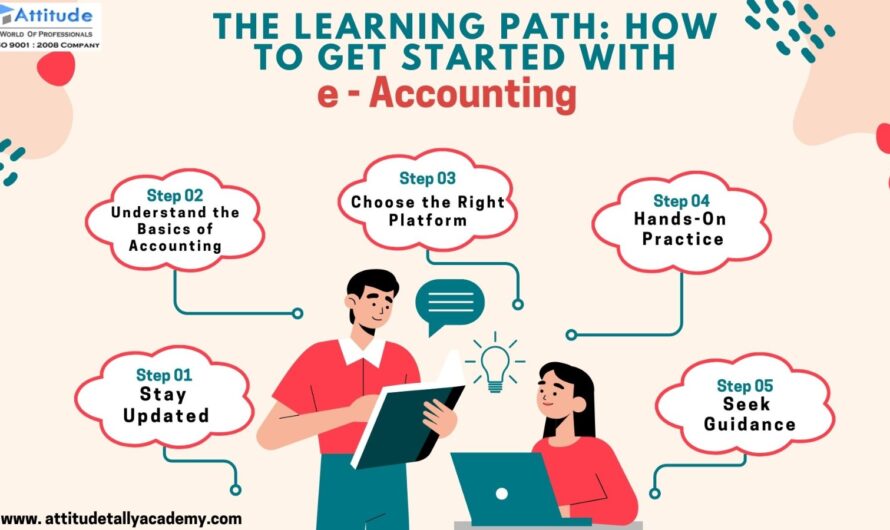

Introduction In today’s digital era, managing finances has transcended the realm of paperwork and calculators. E-accounting is the future of financial management, combining convenience, accuracy, …