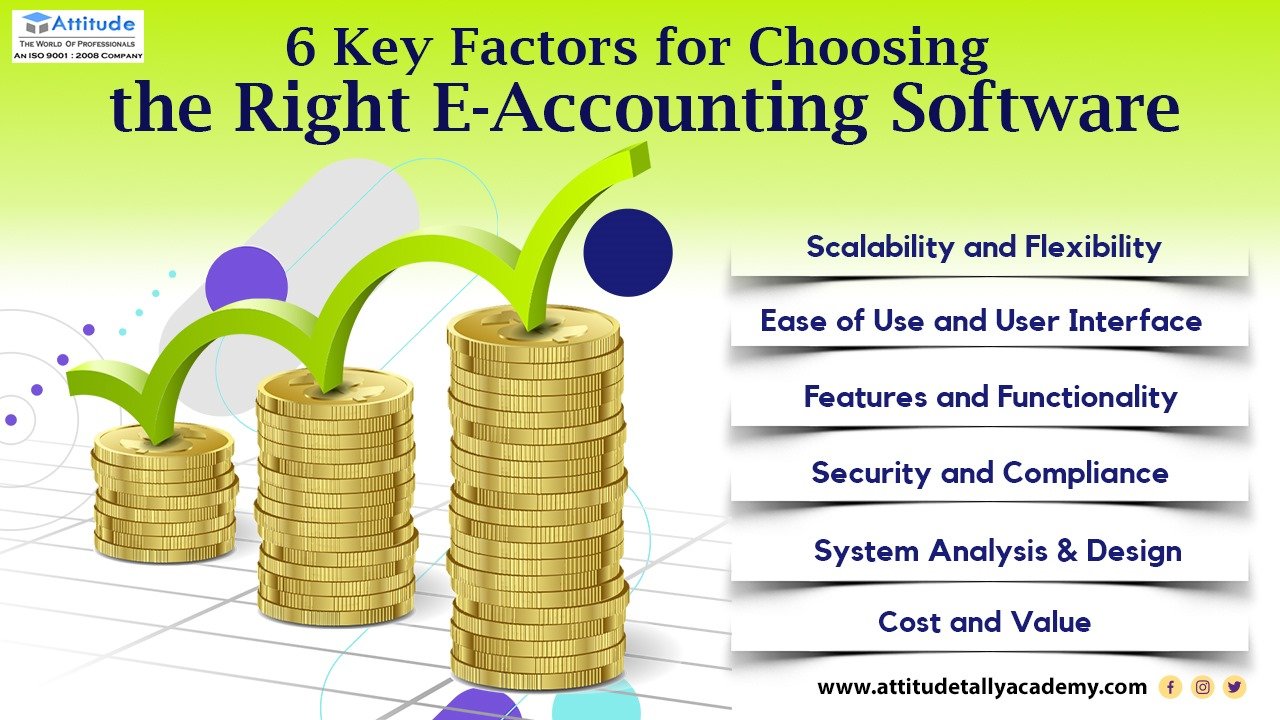

Introduction

In today’s digital age, selecting the perfect e-accounting software is crucial for businesses of all sizes. With the myriad of options available in the market, finding the optimal accounting solution requires careful consideration of various factors. Let’s delve into the six key factors that will guide you towards making the right choice for your business.

Scalability and Flexibility:

One of the foremost factors to consider when choosing e-accounting software is its scalability and flexibility. As your business grows, your accounting needs will evolve as well. Ensure that the software you choose can scale seamlessly with your business expansion. It should offer flexible features that can be customized to accommodate changing requirements without disrupting your operations.

Ease of Use and User Interface:

A user-friendly interface is essential for efficient utilization of e-accounting software. Look for intuitive designs and navigation that simplify complex accounting processes. The software should be easy to learn and use, reducing the learning curve for your team. A visually appealing interface enhances user experience and productivity.

Features and Functionality:

Evaluate the features and functionality offered by e-accounting software in line with your business needs. Essential features include invoicing, expense tracking, financial reporting, inventory management, and payroll processing. Advanced functionalities like automated workflows, bank reconciliation, multi-currency support, and integration with other business tools can further streamline your accounting processes.

Security and Compliance:

Security is paramount when dealing with financial data. Choose e-accounting software that prioritizes data security through robust encryption, regular backups, and secure access controls. Additionally, ensure that the software complies with industry regulations and standards such as GDPR, HIPAA, or PCI DSS, depending on your business requirements.

System Analysis & Design:

Before finalizing an e-accounting software, conduct a thorough system analysis to assess compatibility with your existing IT infrastructure. Consider factors like system requirements, integration capabilities with other software systems (e.g., CRM, ERP), and technical support provided by the vendor. A well-designed software solution should seamlessly integrate with your business ecosystem.

Cost and Value:

Last but not least, consider the cost and value proposition of the e-accounting software. Compare pricing plans, licensing models, and additional fees for upgrades or support. While cost is a factor, prioritize value by assessing the software’s return on investment (ROI) in terms of time saved, improved accuracy, reduced errors, and enhanced decision-making capabilities.

In conclusion,

The right E-accounting software selection involves a holistic approach encompassing scalability, ease of use, features, security, compatibility, and cost-effectiveness. By focusing on these six key factors and conducting thorough research, you can make an informed decision that aligns with your business goals and ensures optimal accounting efficiency.

Suggested Links: –