- Financial e-Accounting

- Tally ERP9

Complete Tally ERP9 with GST

Advanced Tally ERP9 Datailed Course

- 10 - 20 weeks

- 102 Lectures

- 7869 Student Enrolled

- Offer by ATTITUDE ACADEMY

- Last updated:- Feb 20, 2024

₹499.00 97% Off

- 20 Hours Online Sessions

- 50 Videos for Covering Complete Training

- Complete eBook with Assignments

- Online Offline Assessments

- 100% Job Assistance

- 24*7 Lifetime Access

- Govt. Recognized Certificate

What you'll learn

- Manual Accounting: Voucher Preparation, Day Book Preparation, Cash Book preparation, Ledger Writing, Stock Register, Purchase Register Preparation, Sales Register Preparation, Profit and Loss Account, Balance Sheet etc.

- Tally ERP: Accounting & Inventory

- Tally ERP: Payroll & Labour Laws

- Tally ERP Taxation: GST, TDS and Income Tax

- Tally ERP: Banking

Requirements

- Need a Desktop or Laptop with Tally ERP9 Software Installed in it.

- Basic Knowledge of Computer

What placement assistance will you receive?

Free Placement Preparation Training

Access to curated Internships & Current Job Openings.

Top performers will be highlighted on Attitude Job portal

Requirements

Tally ERP 9 provides a comprehensive solution to the accounting and inventory needs of a business. The package comprises GST (goods and services tax), financial accounting, Book-keeping and inventory accounting. Tally is popularly known as an accounting software for small and medium businesses. It does all the functions of accounting that a particularly mid sized business has.

Course Circullum

- Basics of Accounting

-

Fundamentals of Tally.ERP 9

-

Create Accounting Masters in Tally.ERP 9

-

Accounting Vouchers

-

Financial Statements and Accounting Books & Reports

- Creating Inventory Masters in Tally.ERP 9

-

Inventory Vouchers

-

Generating Inventory Books & Reports

- Multilingual Capabilities

-

Technological Advantages of Tally.ERP

-

Tally.NET and Remote Capabilities

-

Application Management

-

Online Help and Support

- Bill –wise Details

-

Cost Centres and Cost Categories

-

Voucher Classes

-

Multiple Currencies

-

Interest Calculations

-

Budget & Controls

-

Scenario Management

-

Banking

- Order Processing

-

Multiple Price Level

-

Tracking Numbers

-

Batch – wise Details

-

Additional Cost Details

-

Bill of Materials (BoM)

-

Price Levels and Price Lists

-

Stock Valuation

-

Zero Valued Entries

-

Inventory Analysis

-

Different Actual and Billed Quantities

-

Job Costing

-

Job Order Processing

- Generation of Employee Database, Salary Structure & Calculation Attendance & Leave Details, Salary Slip Generation, PF, ESI, Gratuity Bonus, Professional Tax, Various Anal ytical Reports etc.

- Start Using Tally.ERP 9 for GST Compliance

-

Activating GST for Your Company

-

Setting Up GST Rates

-

Updating Stock Items and Stock Groups for GST Compliance

-

Updating a Service Ledger for GST Compliance

-

Updating Sales and Purchase Ledgers for GST Compliance

-

Updating Party GSTIN.

-

Creating GST Ledgers

-

Creating Income and Expense Ledgers

-

Recording Sales and Printing Invoices

-

Recording Purchases

-

Recording a Tax Payment

-

Other Scenarios

-

Sales - Nil Rated, Exempt, SEZ, and Deemed Export

-

Recording Sales Returns

-

Recording Purchase Returns

-

Recording an Advance Receipt from Customer

-

Recording an Advance Payment to Supplier

-

Recording Journal Vouchers for Adjustments Against Tax Credit

-

GSTR-1, GSTR-2A, GSTR-2, GSTR-3B

-

Returns Summary

-

Particulars (Computation Details)

-

Summary of Exceptions

-

Table-wise GSTR-1, GSTR-2A, GSTR-2, GSTR-3B

-

Status Reconciliation

-

Exporting GSTR-1, GSTR-2A, GSTR-2, GSTR-3B

-

Challan Reconciliation

- TDS (Tax Deducted At Source) Entry

-

TCS(Tax Collected At Source) Entry

-

Challans Of TDS & TCS

-

Form of TDS & TCS

-

Reports of TDS & TCS

How will your training work?

Classes

Watch recorded & live videos to learn various concepts & get Live Sessions with Trainer for Doubts Clearing.

Exams

Test your knowledge through quizzes & module tests. Take online exam & get instant result.

Projects

Get hands on practice by doing assignments and live project

Certificate

Take the final exam to get certified in Complete Tally ERP9 with GST

Turab Haider

- Videos

- Lectures

- Exp.

More than 8 years of Experience in Accounts,Complete knowledge of TALLY software ERP 9 & Tally Prime with GST returns - GSTR1 GSTR-3B , R9 ,BUSY, Taxation, e-filing,compiling and presenting reports, budgets, business plans, commentaries and financial statements.administering payrolls and controlling income and expenditure.administering payrolls and controlling income and expenditure.

- Accounts payable Accounts receivable Profit-and-loss statements Tax preparation Expense reports Cost reduction proposals Budgets Internal audits for tax codes Presenting budgets and reports to upper management

Reviews - 0

Releated Courses

₹499.00 ₹15000.00

97% Off

Coupon Code: OFF10COURSE

- 20 Hours Online Sessions

- 50 Videos for Covering Complete Training

- Complete eBook with Assignments

- Online Offline Assessments

- 100% Job Assistance

- 24*7 Lifetime Access

- Govt. Recognized Certificate

How will your doubts get solved?

You can post your doubts on the Q&A forum which will be answered by the teachers within 24 hours.

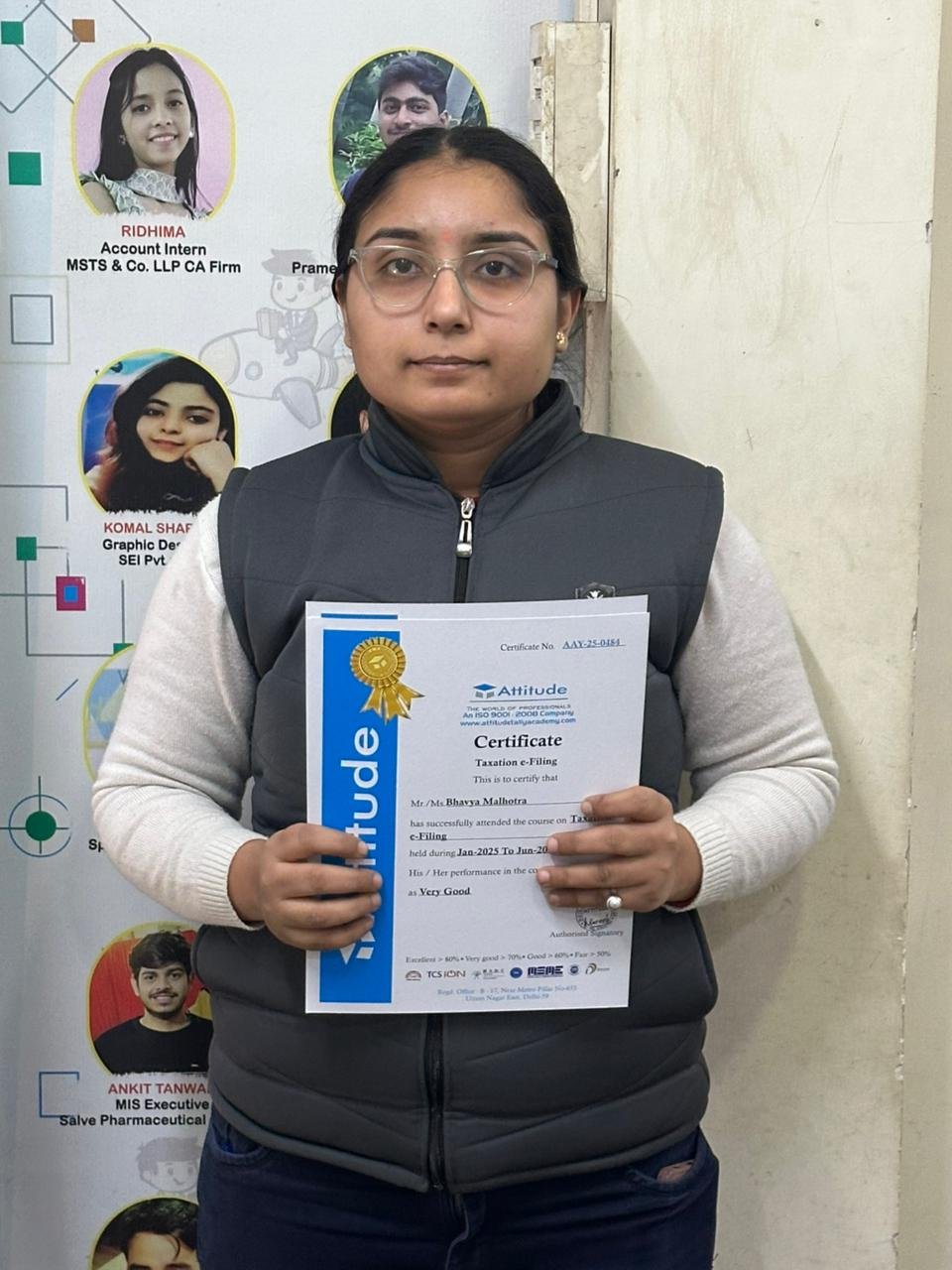

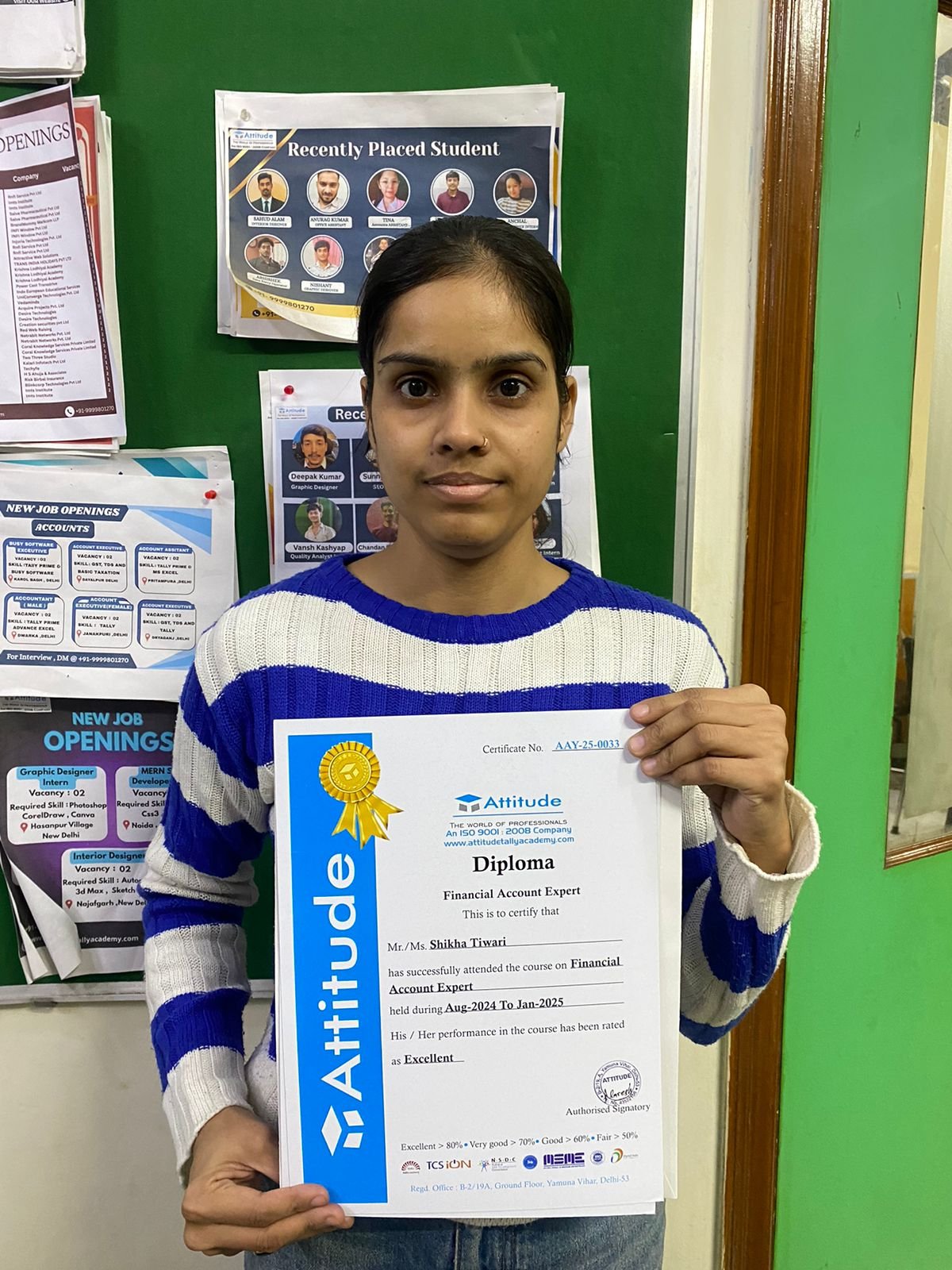

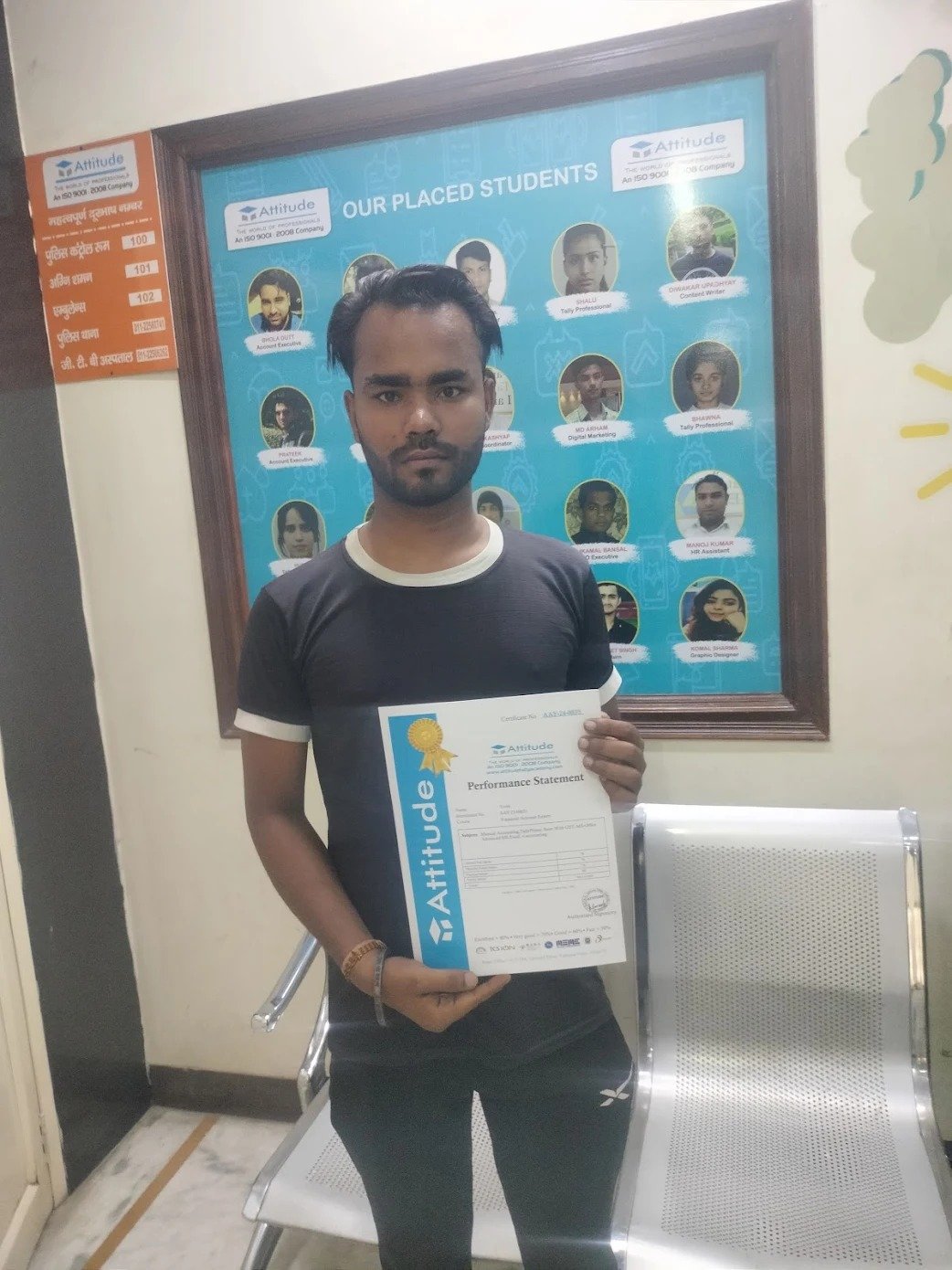

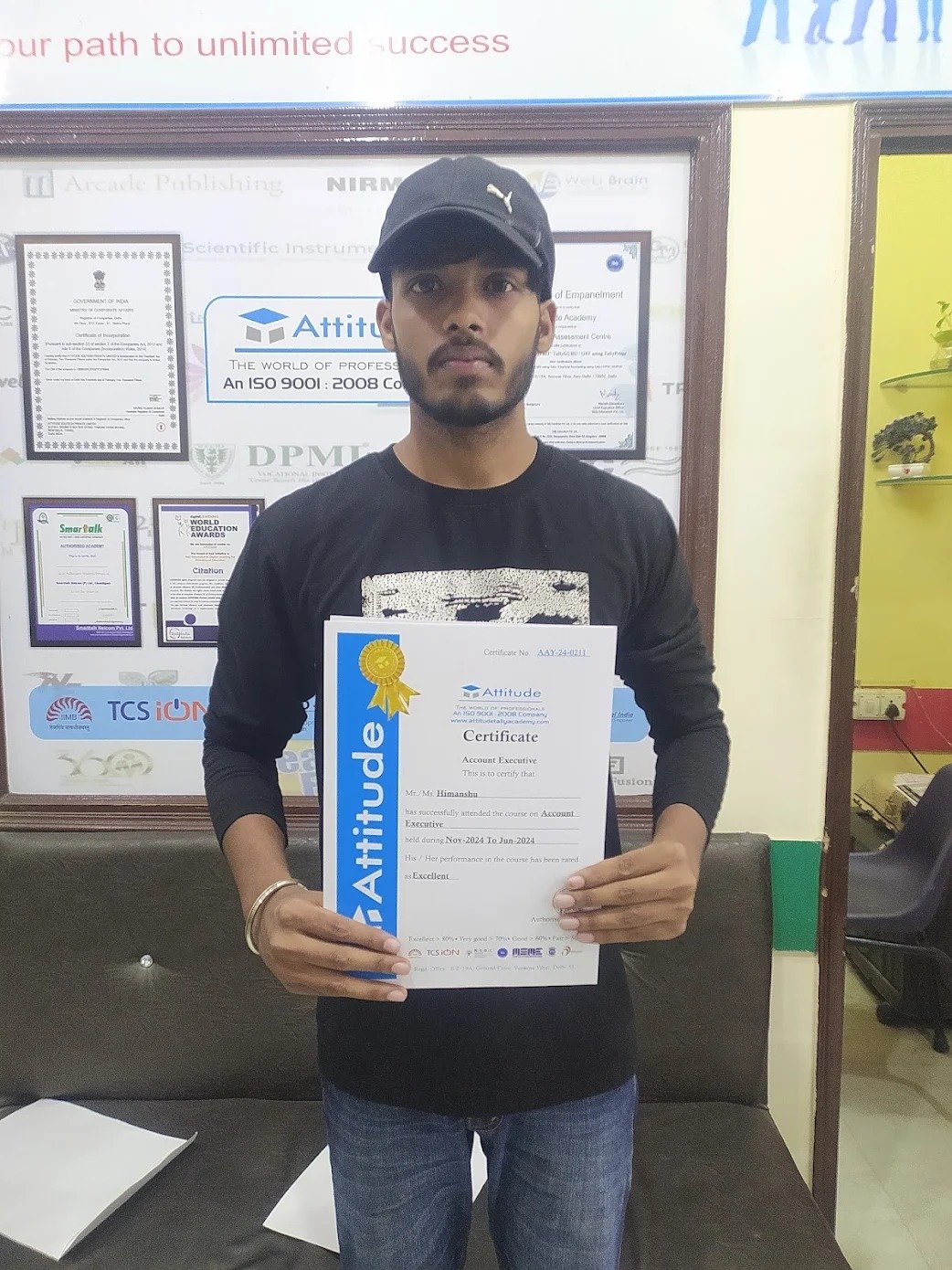

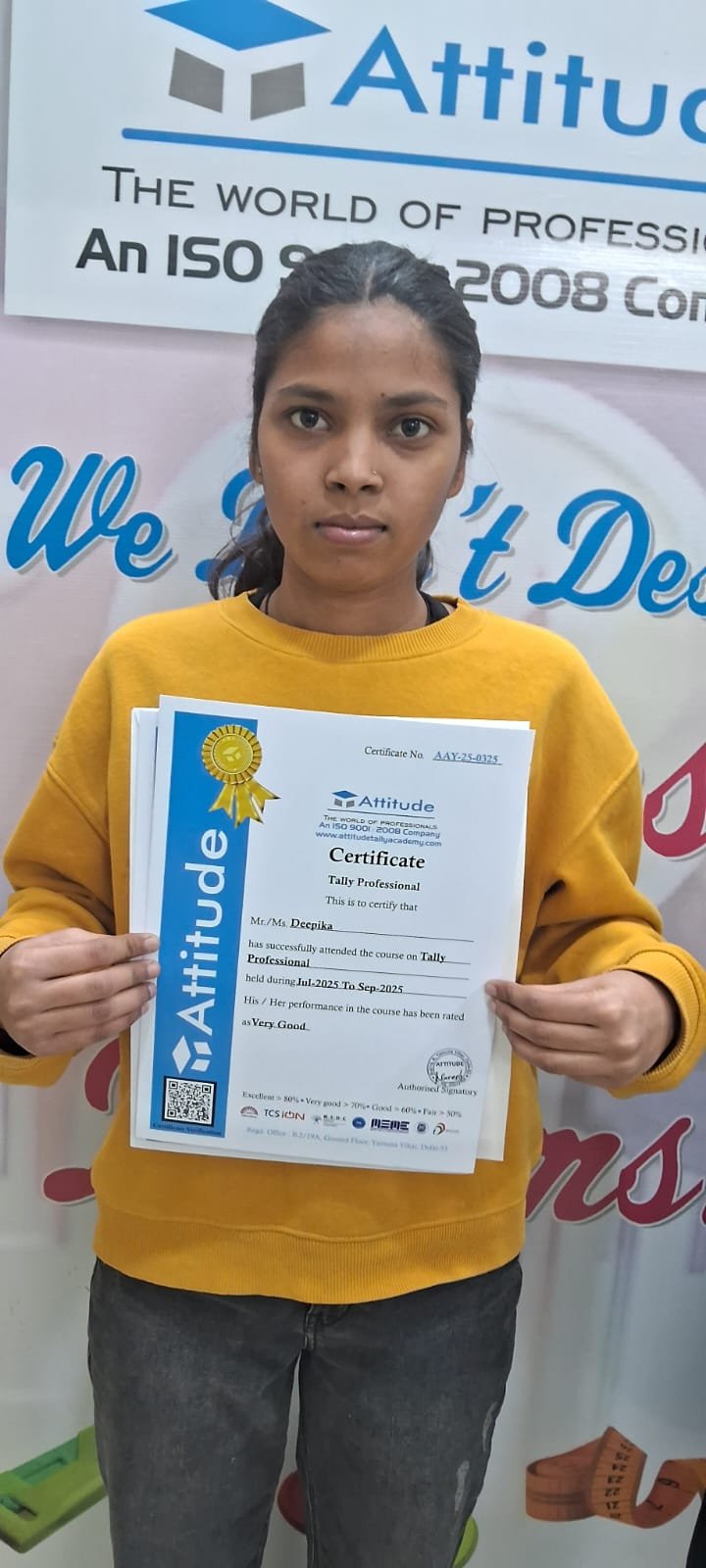

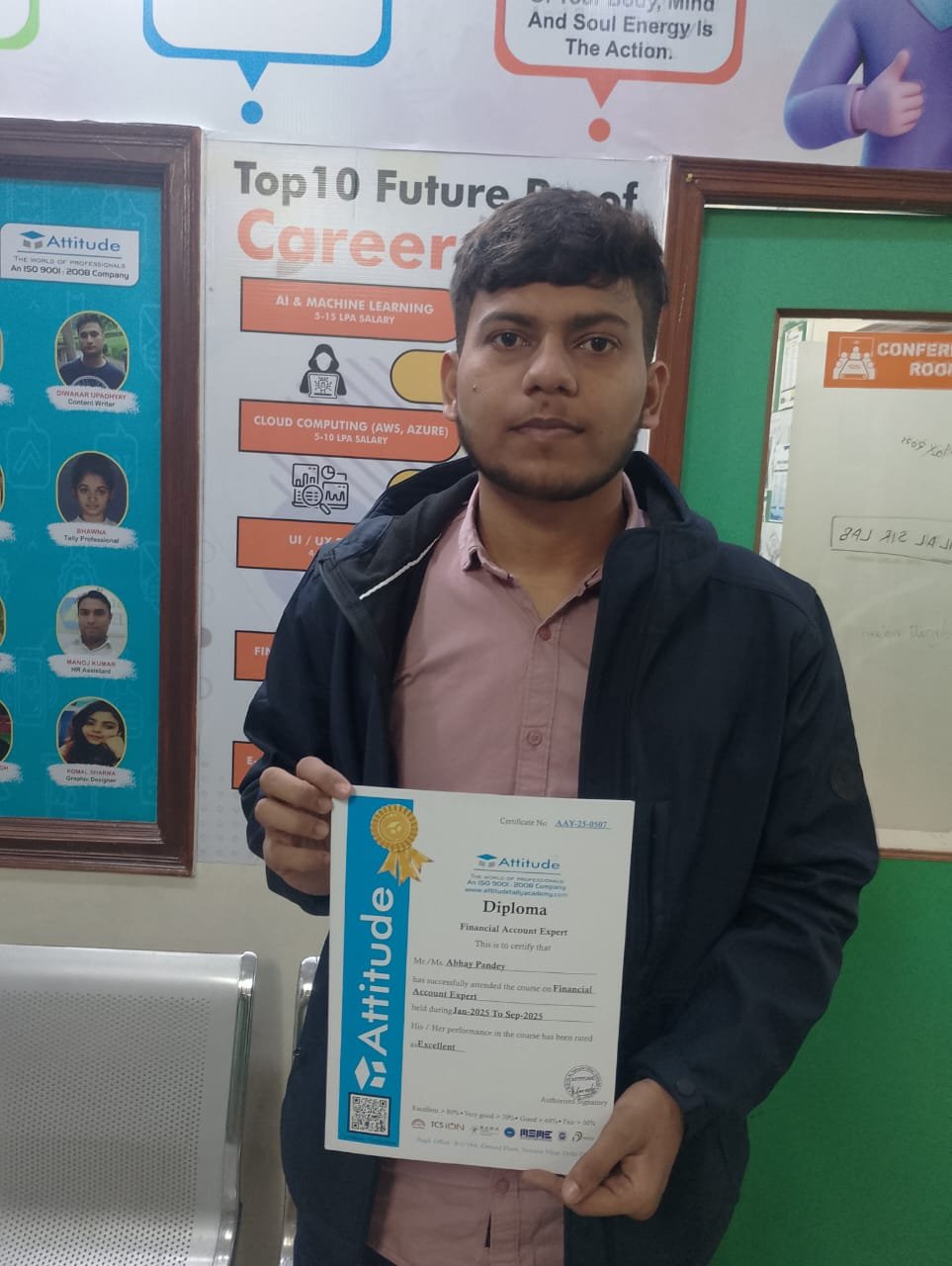

100% Placement Assistance

Meet Our Placed Students

Commonly Asked Questions

Q. What are the prerequisites for the training?

There are no prerequisites for this training as it is of beginner level. Everything that you need to know about Complete Tally ERP9 with GST would be taught to you from scratch.

Q. Do I need to have a laptop or desktop to do the training or can I do it on mobile too?

You can watch the videos and take quizzes & tests on any device including mobile. However, for assignments and practice, use of desktop or laptop is required.

Q. What system configuration is needed to do this training?

Q. When can I start the training?

You can choose your preferred batch date while signing up for the training program and start accordingly.

Q. Will I be getting a hard copy of the certificate?

No, you will be only getting a soft copy of the certificate which you can download and print out if required.

Q. What placement assistance will I receive from Attitude as part of the training?

- You will receive free access to Placement Preparation Training on the platform which covers resume writing, cover letter writing, how to search and apply for internships and jobs on Attitude, and interview preparation. This training comes with a lifetime access meaning you can use it later also if you are not applying for internships or jobs right now.

- Access to curated internships & jobs related to the training - after completing the training, you would receive a list of handpicked internships or jobs every week that you can apply to as per your preference.

- If you are a top performer, a badge of achievement will be added to your Attitude resume and shown to the employers when you apply to internships or jobs on Attitude.

Q. Does Attitude Trainings guarantee a job or internship placement?

While many of our students have found their desired internships or jobs after completing their training, Attitude Trainings does not guarantee an internship or job. However, if you study sincerely (including doing exercises, assignments, and projects) and make good use of our placement assistance feature, it will become easier for you to get a placement using the skills learned in the training.

Q. I’m not able to make payment. What should you do now?

You could try making the payment from a different card or account (of a friend or family). Otherwise, you can follow the instructions on how to make an offline payment.

Q. The payment shows failed but money got deducted? What should I do now?

The amount deducted will come back to your account within 3-5 working days. This is the normal duration your bank will take to credit the amount back into your account.

.jpeg)