- Financial e-Accounting

- GST in Tally.erp9

Complete GST Course with e-Filing

Gain insight into Theoretical as well as Practical angle of GST from this course based Live Sessions & Recorded video.

- 10 - 20 weeks

- 102 Lectures

- 4526 Student Enrolled

- Offer by ATTITUDE ACADEMY

- Last updated:- Feb 20, 2024

₹499.00 97% Off

- Online Interactive Learning Sessions

- Practical Videos For Covering Course

- Complete eBook with 500+ Assignments

- Online Offline Assessments

- Course Related Blogs & Articles

- 100% Job Assistance

- Access on All Device

- 24*7 Lifetime Access

- Govt. Recognized Certificate

What you'll learn

- Introduction Of GST

- Concept Of CGST & SGST

- Concept Of IGST

- GST Return GSTR 1, GSTR 2, GSTR 3B

- GSTR 2A, GSTR 9

- EWAY BILL

Requirements

Be able to operate a PC. That's all.

What placement assistance will you receive?

Free Placement Preparation Training

Access to curated Internships & Current Job Openings.

Top performers will be highlighted on Attitude Job portal

Requirements

GST is known as Goods and Services Taxi and is proposed to be a comprehensive indirect tax implied on manufacture, sale and consumption of goods as well as services at the national level and Attitude Tally Academy has started a new GST course online & offline. Our institute Attitude Tally Academy is offering a GST course for the students who wish to pursue their career in the fields of accounts, here in Attitude Tally Academy Online classes of GST are provided under the leadership of highly qualified and experienced trainers. Our Excise Executive course help professionals to develop career with 100% job placement opportunity.

Course Circullum

- Principles

-

Important Definitions

-

Why GST is Necessary?

-

Impact of GST.

-

Benefits

-

Different Rates of GST.

-

FAQ

- Concept Of Supply

-

Different Place of Supply

-

Intra State Vs Inter State

-

FAQ

- Eligibility & Conditions for taking ITC

-

CGST

-

SGST

-

IGST

-

FAQ

- Invoice Type

-

B2B Concept

-

B2C Concept

-

Zero Rated Supply

-

FAQ

- Definition & Important Notes to Return.

-

Types of Returns

-

Various Return Form

-

Return Process GSTR 1, GSTR 2, GSTR 3B

-

Return Process GSTR 2A, GSTR 9

-

FAQ

E-Way Bill is an electronic way bill for movement of goods which can be generated on the e-Way Bill Portal. Transport of goods of more than Rs. 50,000 in value in a vehicle cannot be made by a registered person without an e-way bill. Alternatively, E-way bill can also be generated or cancelled through SMS, Android App and by Site-to-Site Integration (through API). When an e-way bill is generated a unique e-way bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

IDENTIFY E-WAY BILL GENERATION SCENARIOUS UNDER GST

- IDENTIFY -Various movements which take place on daily basis

- SALE, PURCHASE – goods sent for repairs, job work, sales return, purchase return, imports and exports

- TRANSACTIONS WITH UNREGISTERED DEALERS ETC.

FIX RESPONSIBILITY FORE-WAY BILLS

- AGREEMENTS with business participants on roles/responsibilities

- UPDATING E-way bill in case of change in conveyance

- BREAKDOWN of conveyance

- EXPIRY OF VALIDITY of E-way bill

- RETURN OF GOODS FROM customer premises without acceptance, etc.

OBTAIN GST REGISTRATION NUMBER

- PREREQUISITE FOR generation of E-way bill

How will your training work?

Classes

Watch recorded & live videos to learn various concepts & get Live Sessions with Trainer for Doubts Clearing.

Exams

Test your knowledge through quizzes & module tests. Take online exam & get instant result.

Projects

Get hands on practice by doing assignments and live project

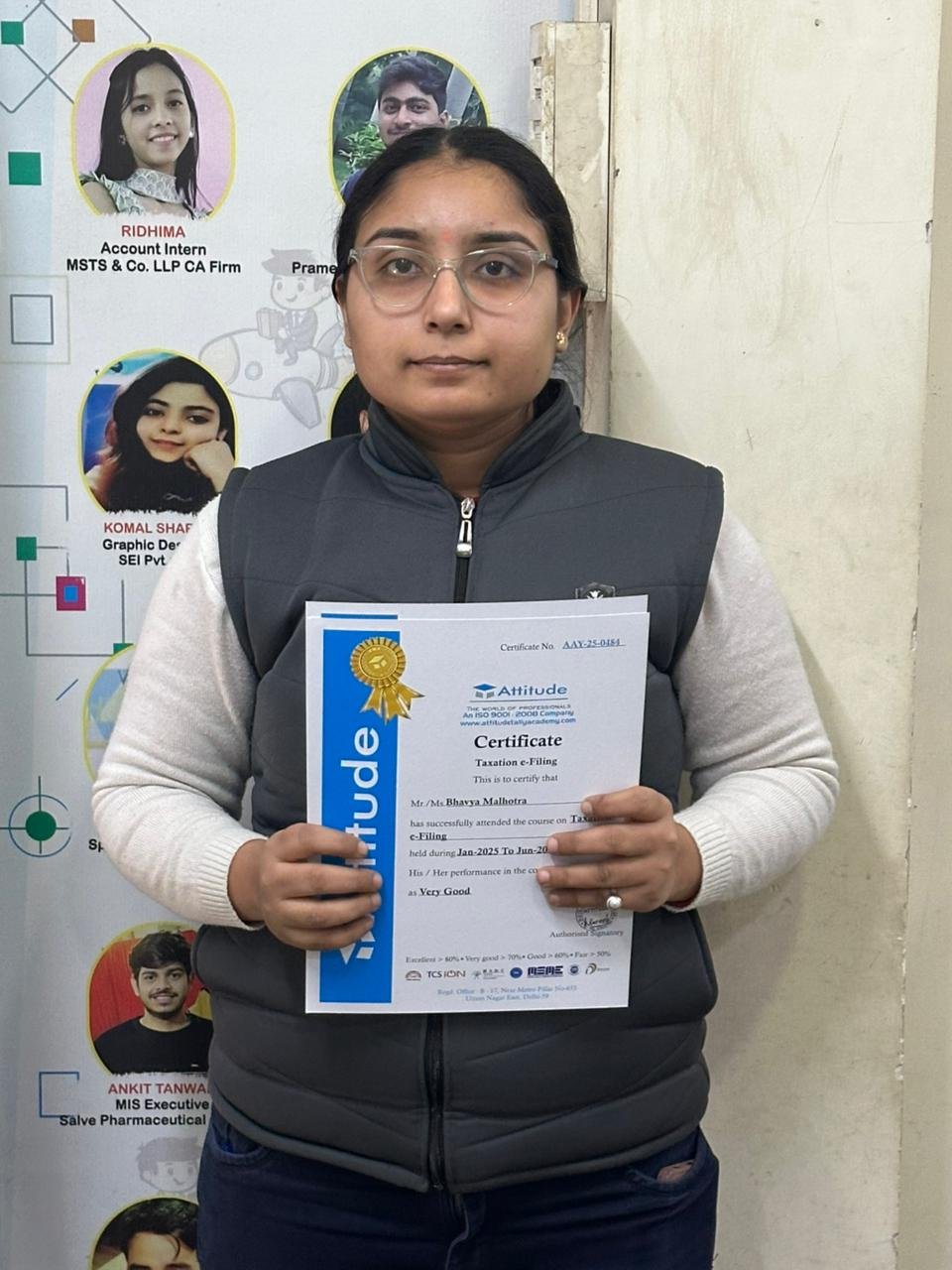

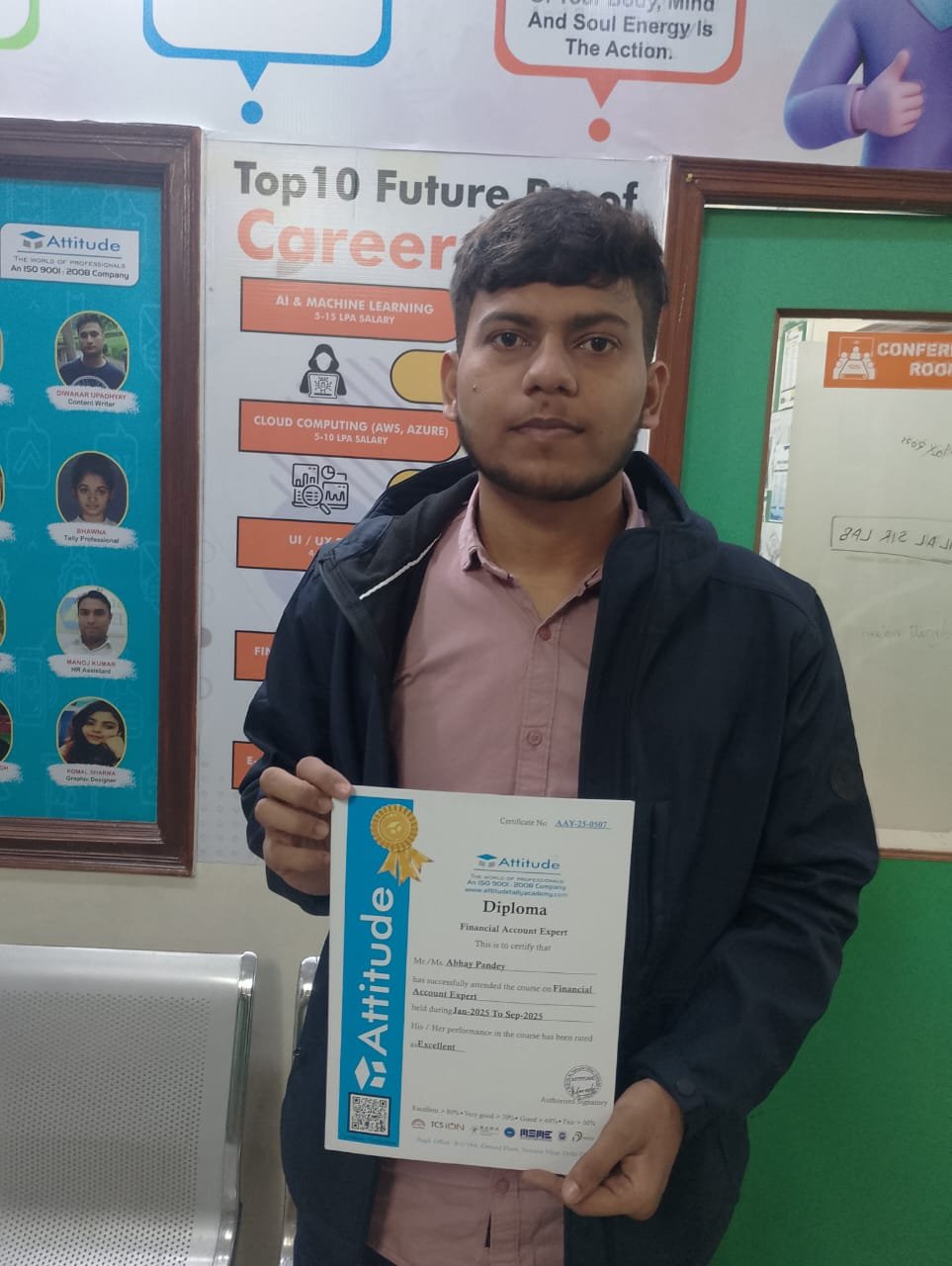

Certificate

Take the final exam to get certified in Complete GST Course with e-Filing

Turab Haider

- Videos

- Lectures

- Exp.

More than 8 years of Experience in Accounts,Complete knowledge of TALLY software ERP 9 & Tally Prime with GST returns - GSTR1 GSTR-3B , R9 ,BUSY, Taxation, e-filing,compiling and presenting reports, budgets, business plans, commentaries and financial statements.administering payrolls and controlling income and expenditure.administering payrolls and controlling income and expenditure.

- Accounts payable Accounts receivable Profit-and-loss statements Tax preparation Expense reports Cost reduction proposals Budgets Internal audits for tax codes Presenting budgets and reports to upper management

Reviews - 0

Releated Courses

₹499.00 ₹18000.00

97% Off

Coupon Code: OFF10COURSE

- Online Interactive Learning Sessions

- Practical Videos For Covering Course

- Complete eBook with 500+ Assignments

- Online Offline Assessments

- Course Related Blogs & Articles

- 100% Job Assistance

- Access on All Device

- 24*7 Lifetime Access

- Govt. Recognized Certificate

How will your doubts get solved?

You can post your doubts on the Q&A forum which will be answered by the teachers within 24 hours.

100% Placement Assistance

Meet Our Placed Students

Commonly Asked Questions

Q. What are the prerequisites for the training?

There are no prerequisites for this training as it is of beginner level. Everything that you need to know about Complete GST Course with e-Filing would be taught to you from scratch.

Q. Do I need to have a laptop or desktop to do the training or can I do it on mobile too?

You can watch the videos and take quizzes & tests on any device including mobile. However, for assignments and practice, use of desktop or laptop is required.

Q. What system configuration is needed to do this training?

Q. When can I start the training?

You can choose your preferred batch date while signing up for the training program and start accordingly.

Q. Will I be getting a hard copy of the certificate?

No, you will be only getting a soft copy of the certificate which you can download and print out if required.

Q. What placement assistance will I receive from Attitude as part of the training?

- You will receive free access to Placement Preparation Training on the platform which covers resume writing, cover letter writing, how to search and apply for internships and jobs on Attitude, and interview preparation. This training comes with a lifetime access meaning you can use it later also if you are not applying for internships or jobs right now.

- Access to curated internships & jobs related to the training - after completing the training, you would receive a list of handpicked internships or jobs every week that you can apply to as per your preference.

- If you are a top performer, a badge of achievement will be added to your Attitude resume and shown to the employers when you apply to internships or jobs on Attitude.

Q. Does Attitude Trainings guarantee a job or internship placement?

While many of our students have found their desired internships or jobs after completing their training, Attitude Trainings does not guarantee an internship or job. However, if you study sincerely (including doing exercises, assignments, and projects) and make good use of our placement assistance feature, it will become easier for you to get a placement using the skills learned in the training.

Q. I’m not able to make payment. What should you do now?

You could try making the payment from a different card or account (of a friend or family). Otherwise, you can follow the instructions on how to make an offline payment.

Q. The payment shows failed but money got deducted? What should I do now?

The amount deducted will come back to your account within 3-5 working days. This is the normal duration your bank will take to credit the amount back into your account.