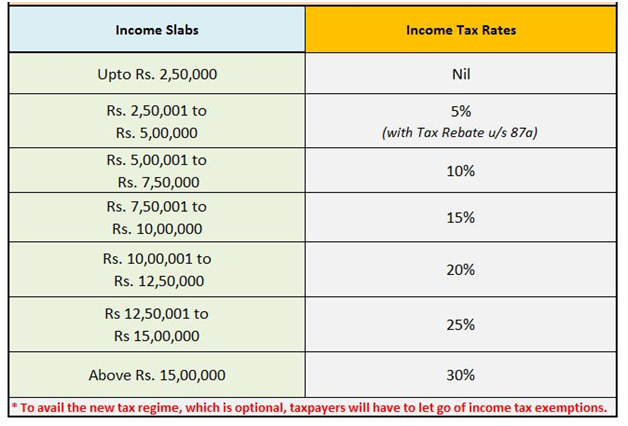

Union Finance Minister Nirmala Sitharaman announced a symbolic cut in the tax rates for the salaried class in her Budget speech, provided they forgo existing exemptions. This also attendant in a new tax regime where the taxpayer has the option of taking new rates without exemptions or sticking to old rates with exemptions. New income tax slabs & rates for assessment description is below.

Union Finance Minister Nirmala Sitharaman said this was to simplify the tax regime which was riddled with multiple exemptions and needed taxpayers to take the help of the professionals.

As per the new tax rates, income under Rs 5 Lakhs per annum will remain untaxable as it was earlier. Means No Tax Charge Upto 5 Lakhs. She Said That those earning between Rs 5 – Rs 7.5 lakhs per annum will now pay 10% tax on their incomes which were earlier 20%. The Finance Minister proposed a cut of 5% from the existing 20% for those earning between Rs 7.5 lakh to Rs 10 lakh per annum Now They will have to pay 15% tax. Sitharaman announced that those earning between Rs 10 lakhs to Rs 12.5 lakhs per annum will now have to pay 20% tax. Earlier it was 30 %.

Attitude Academy Provide You All Details Of tax slabs And Budget 2020-21. If You Want To Learn Tax With Us So Contact Now.

The new tax rate relevant to those earning in the range of Rs 12.5 lakh per annum to Rs 15 lakh per annum will be liable to pay tax at the rate of 25%. As per the new Income tax Rate regime, 30% tax will be charged on salaries above Rs 15 lakh per annum.

New income tax rates for assessment year 2021-22

1. New income tax rate regime: 10% tax for income between Rs 5 and Rs 7.5 lakh

2. New income tax rate regime: 15% tax for income between 7.5 lakh and 10 lakh

3. New income tax rate regime: 20% tax for income between 10 lakh and 12.5 lakh

4. New income tax rate regime: 25% tax for income between 12.5 lakh and 15 lakh

5. New income tax rate regime: 30% tax for income above 15 lakh

The new rates will apply to only those individuals who abdicate certain exemptions and deductions.

The Union Finance Minister Nirmala Sitharaman said the proposal for the new tax regime will lead to a revenue sacrifice of Rs 40,000 crore per annum for the government. She also said that the government has initiated measures to prefill the income tax return so that an individual, who opts for the new regime, would need no assistance from an experienced to file his return and pay income tax.

Union Finance Minister Nirmala Sitharaman said there are at least 100 tax exemptions in the existing tax regime, which will be reduced by 70 under the new tax regime. The remaining exemptions will be reviewed and examined in due course, she said. Union Budget 2020-21 also modification to exemptions which allowed “individuals, who are actually carrying out substantial economic activities from India, manage their period of stay in India,” so as not to announce their global income in India.

amid the fiscal decline, it was conventional that the government would cut tax rates for the salaried class to increase consumer spending and boost the domestic consumption of goods.

New Slabs & Rates : 2020-21 (AY 2021-22)

Income Tax Slabs & Rates for Individual Tax Payers & HUF (Less Than 60 Years Old) for FY 2019-20

| Slabs | Tax Rate for Individual & HUF Below the Age Of 60 Years |

| Up to ₹2,50,000* | Nil |

| ₹2,50,001 to ₹5,00,000 | 5% of total income exceeding ₹2,50,000 |

| ₹5,00,001 to ₹10,00,000 | ₹12,500 + 20% of total income exceeding ₹5,00,000 |

| Above ₹10,00,000 | ₹1,12,500 + 30% of total income exceeding ₹10,00,000 |

Note : An additional 4% Health & education cess will be applicable on the tax amount calculated as above.

Income Tax Slabs for Senior Citizens (60 Years Old Or More but Less than 80 Years Old) for FY 2019-20

| Slabs | Tax Rate for Senior cetizens aged 60 Years But Less than 80 Years |

| Income up to Rs 3,00,000* | No tax |

| Income from Rs 3,00,000 – Rs 5,00,000 | 5% |

| Income from Rs 5,00,000 – 10,00,000 | 20% |

| Income more than Rs 10,00,000 | 30% |

Note : An additional 4% Health & education cess will be applicable on the tax amount calculated as above.

Slabs for Super Senior Citizens(80 Years Old Or More) for FY 2019-20

| Slabs | Tax Rate for Super Senior Citizens (Aged 80 Years And Above) |

| Income up to Rs 5,00,000* | No tax |

| Income from Rs 5,00,000 – 10,00,000 | 20% |

| Income more than Rs 10,00,000 | 30% |

Note : An additional 4% Health & education cess will be applicable on the tax amount calculated as above.

Slabs for Domestic Companies for FY 2019-20

| Turnover Particulars | Tax Rate |

| Gross turnover upto 400 Cr. in the FY 2017-18 | 25% |

| Gross turnover exceeding 400 Cr. in the FY 2017-18 | 30% |

| Where the company opted for Section 115BA | 25% |

| GWhere the company opted for Section 115BAA | 22% |

| Where the company opted for Section 115BAB | 15% |

In addition cess and surcharge is levied as follows:

Cess: 4% of corporate tax

Surcharge applicable:

| Income Limit | Surcharge Rate on the amount of income tax |

| Net income exceeds Rs.1 Crore but doesn’t exceed Rs.10 Crore | 7% |

| Net income exceeds Rs.10 Crore | 12% |

Informative and useful article.

Thank You

Very informative article with tons of knowledge. Thanks for sharing!

I found your article very informative and I totally love how the concepts are explained in this blog post. Thanks for sharing your insights. It helps a lot.