Join Tally GST Training Course

Tally is the most popular and highly effective accounting tool which makes the life of an accountant easier. Anyone who is looking to make his/her career in this field of e-accounting or wishes to lead a successful professional career in e-accounting must learn Tally ERP9 & GST as the benefits of using Tally ERP9 & GST is more for both small and medium-sized businesses.

Tally GST Training Course

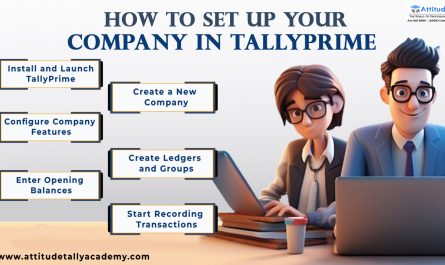

This course covers Tally GST with Advance Excel. Learn Basic to Advance Level Accounting with our master and experienced workforce. All points are secured with a reasonable comprehension and use of the ideas of Goods and Services Tax (GST). Get familiar with all Goods and Service Tax Returns documenting procedure utilizing on the web entrance and disconnected Tools given by GSTN. Count ERP 9 Course with GST covers the top to bottom learning to meet the bookkeeping prerequisites of the business.

This Tally GST course encourages you to Implement Goods and Service Tax, covering every propelled theme, for example, cost focuses, work costing, stock, personal expense, TDS, e-way charges, spending Management, represents exchanging organization, represents assembling organization, represents administration part organization, Bank Reconciliation, MIS reports, GST returns for ordinary and piece vendors, GST, TDS Returns Form 26Q, and so on.

Who is eligible to Join Tally ERP 9 Course with GST?

• Who wants to make a successful accounting career.

• Who wants to learn advance Accounting keys.

• Who wants to manage accounts independently.

• Who wants to learn and perform accounting, inventory and taxation work on Tally.

• Commerce Students.

• Entrepreneur

For an entrepreneur is important to keep eyes on cash & fund flow, profits, finance, reporting, budget making, working capital, MIS reporting and other valuable information that helps him to grow his business and taking the right decisions in business plans, so it’s become more important to him to have knowledge of tally software so that he/she can analyze the data and make the right decision. Any stream students whatever student of class 11th, 12th, graduate and post-graduate must learn to account because every of Indian small and medium scale companies use accounting in their day to day working.

Tally is the best option to implement GST in your business. In this course, we have talked about every topic in detail that how to apply GST in Tally and making all returns.

You will learn all in details with hands-on projects & real-life examples. This course intends to make the participants experts in Tally ERP9 in every aspect, this help in making your career.

Requirements

Need basic knowledge of Computer that’s it.

What will you learn?

Accounting training is the most important feature of Tally ERP. The main thought that comes in mind of a person when hearing about tally is accounting.

Billing is important part of business, this feature is included Tally. Actually billing is included in the accounting feature whenever you pass an accounting entry simultaneously a bill is generated which can be used for raising or sending invoice.

Payroll feature is of use when you are having a good number of employees. For managing payroll in tally, there are many uses likeemployee groups, employee categories,course employeesattendance, pay heads etc.

Support of a stock is a significant piece of business as it gives better control on business deals subsequently development of a stock is indispensable part which can be monitored.

In this era of digital media, without maintaining good banking no business can survive. All banking& non-banking sectors functionality is very well covered by Tally. Though it was not present in earlier versions of Tally it can be useful in ERP-9 TAXATION: TDS GST both direct and indirect tax can be calculated automatically and its returns are also filed online with the help of Tally ERP.

How can I join Tally ERP 9 Course with GST?

You can join this course by taking admission at our centre for an offline classroom-based regular mode course or download our e-book for online leaning as well.

Do you provide Tally Software with your Course?

No, we are an educational institute, and we provide only courses for Computer & IT. However, if you want to download the latest tally software version then you can visit tally solution’s website for more information.

Is it difficult to learn?

Absolutely not, all points are explicated through step by step method in a very easy way, which is very simple to a student to learn & grow his/her tally skills. The complete tally course is developed to meet the requirements of the industry – approved from business expert and professional.

Will I get Practice Files?

Yes, we have provided to our studentslive projects to practice on every topic and become tally professional.

Will I get a placement?

Yes, you will get 100% placement from our hand. Check out our successfully placed students.

Freelancer Opportunity

- Handle all Accounting of Any Company Independently

- You can create any MIS related to business

- You can Handle Payroll includes treatment of prostatitis with homeopathy which payroll register, salary processing

- You can handle Project Accounting Requirements

Join our Tally GST Course Today –

‘Attitude Tally Academy’ provides Tally Training with GST and advance excel course at Yamuna Vihar & Uttam Nagar institute in Delhi. You can learn complete Tally GST Course Training from one of the best computer institutes in Delhi. When you join this course with us, as a result, you will become a professional accountant. Almost all practical aspect of accounting includes in this course. So please visit our centres to get detail syllabus and meet our faculty.