INTRODUCTION

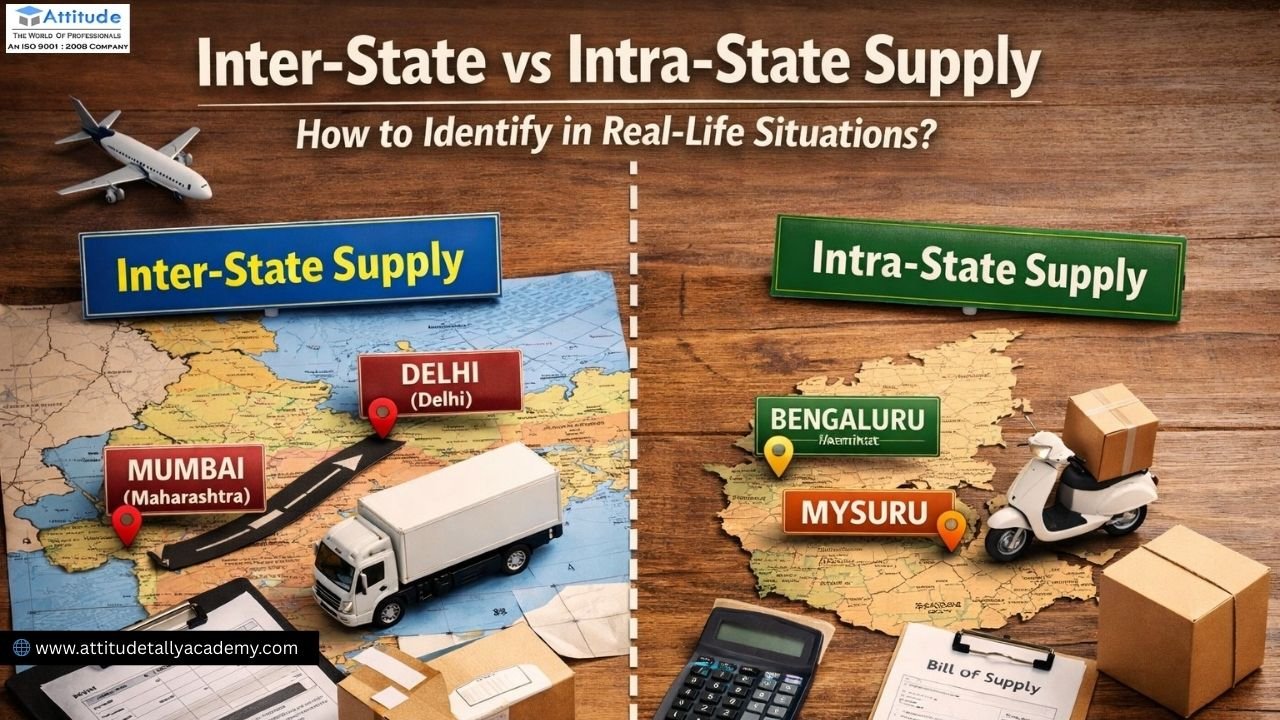

Understanding GST and its practical application is essential for students pursuing accounting, taxation, or finance courses. One of the most important aspects of GST is knowing whether a supply is inter-state or intra-state. This distinction is crucial because it determines the type of tax applied, either IGST or CGST + SGST.

In real-life situations, identifying inter-state and intra-state supply can seem tricky, but it becomes simple once you understand the rules and practical examples.

What is Intra-State Supply?

Intra-state supply happens when the buyer and seller are located within the same state. Both CGST (Central GST) and SGST (State GST) are applicable in such cases.

Example in Real Life:

- A Delhi-based company sells stationery to another business in Delhi.

- Both CGST and SGST are charged on the invoice.

- This is considered an intra-state supply.

Key Indicators:

- The supplier and recipient have the same state GST registration.

- The delivery happens within the same state.

- Invoice clearly mentions CGST and SGST separately.

What is Inter-State Supply?

Inter-state supply occurs when the buyer and seller are in different states. Only IGST (Integrated GST in yamuna vihar) is applicable.

Example in Real Life:

- A company in Uttar Pradesh sells goods to a buyer in Delhi.

- The invoice applies IGST instead of CGST and SGST.

- Transportation crosses state borders.

Key Indicators:

- Supplier and recipient belong to different states.

- Invoice mentions IGST.

- Shipping documents show goods moving between states.

How to Identify GST Supply Type Easily?

Students can use simple strategies to distinguish the supply type:

- Check the Location

- Compare the state of supplier and state of recipient.

- Same state → Intra-state | Different states → Inter-state.

- Look at the GST Invoice

- CGST + SGST → Intra-state.

- IGST → Inter-state.

- Review Transportation Documents

- Bills of supply and delivery notes indicate state-wise movement.

- Understand the GST Registration

- GST numbers contain state codes.

- Matching codes → Intra-state | Different codes → Inter-state.

Why Learning This is Important for Students

- Real-World Knowledge: Students gain practical understanding of GST laws.

- Better Career Opportunities: Professionals with GST knowledge are in high demand.

- Efficiency in Accounting: Correctly identifying supplies reduces errors in tax filing.

- Integration with Software: Modern accounting tools like Tally Prime help automate calculations.

Tools That Make Identification Easy

Several tools can assist in recognizing inter-state and intra-state supplies:

- Tally Prime: Simplifies GST invoicing and tax calculations.

- E-Filing Software: Helps verify IGST, CGST, and SGST automatically.

- E-Accounting Platforms: Provide real-time tax reports and audit support.

Tip for Students: Practicing with Tally Prime or similar platforms improves efficiency.

Practical Examples

- Example 1: A bakery in Yamuna Vihar sells cakes to a café in the same area.

- Invoice shows CGST + SGST → Intra-state supply.

- Example 2: A stationery supplier in Uttam Nagar sends orders to a client in Delhi.

- Invoice shows IGST → Inter-state supply.

- Example 3: Online orders across states using e-commerce platforms often trigger IGST automatically.

These examples demonstrate how GST laws are applied in everyday business transactions.

Suggested Courses for Students

Students seeking a career in finance, accounting, or taxation can benefit from structured learning:

- GST Certification Courses: Provide a clear understanding of tax rules.

- Tally Prime Training: Learn practical accounting and GST filing.

- E-Accounting and E-Filing Training: Enhances digital accounting skills.

Pro Tip: Choosing institutes offering hands-on GST and Tally Prime sessions in uttam nagar can give students practical exposure. Look for institutes in your area that provide professional training in accounting software and GST filing.

Conclusion

Identifying inter-state and intra-state supply is a core skill for students in accounting and taxation. Real-life examples, practical tools like Tally Prime, and structured courses make learning easier.

By mastering these concepts, students can confidently handle GST invoicing, reduce tax errors, and improve their employability. Learning through practical tools and real-world scenarios is always more effective than just theoretical study. VISIT USS…

Suggested Links:

Understanding GST and its practical application is essential for students pursuing accounting, taxation, or finance courses. One of the most important aspects of GST is knowing whether a supply is inter-state or intra-state. This distinction is crucial because it determines the type of tax applied, either IGST or CGST + SGST.

In real-life situations, identifying inter-state and intra-state supply can seem tricky, but it becomes simple once you understand the rules and practical examples.

What is Intra-State Supply?

Intra-state supply happens when the buyer and seller are located within the same state. Both CGST (Central GST) and SGST (State GST) are applicable in such cases.

Example in Real Life:

- A Delhi-based company sells stationery to another business in Delhi.

- Both CGST and SGST are charged on the invoice.

- This is considered an intra-state supply.

Key Indicators:

- The supplier and recipient have the same state GST registration.

- The delivery happens within the same state.

- Invoice clearly mentions CGST and SGST separately.

What is Inter-State Supply?

Inter-state supply occurs when the buyer and seller are in different states. Only IGST (Integrated GST in yamuna vihar) is applicable.

Example in Real Life:

- A company in Uttar Pradesh sells goods to a buyer in Delhi.

- The invoice applies IGST instead of CGST and SGST.

- Transportation crosses state borders.

Key Indicators:

- Supplier and recipient belong to different states.

- Invoice mentions IGST.

- Shipping documents show goods moving between states.

How to Identify GST Supply Type Easily?

Students can use simple strategies to distinguish the supply type:

- Check the Location

- Compare the state of supplier and state of recipient.

- Same state → Intra-state | Different states → Inter-state.

- Look at the GST Invoice

- CGST + SGST → Intra-state.

- IGST → Inter-state.

- Review Transportation Documents

- Bills of supply and delivery notes indicate state-wise movement.

- Understand the GST Registration

- GST numbers contain state codes.

- Matching codes → Intra-state | Different codes → Inter-state.

Why Learning This is Important for Students

- Real-World Knowledge: Students gain practical understanding of GST laws.

- Better Career Opportunities: Professionals with GST knowledge are in high demand.

- Efficiency in Accounting: Correctly identifying supplies reduces errors in tax filing.

- Integration with Software: Modern accounting tools like Tally Prime help automate calculations.

Tools That Make Identification Easy

Several tools can assist in recognizing inter-state and intra-state supplies:

- Tally Prime: Simplifies GST invoicing and tax calculations.

- E-Filing Software: Helps verify IGST, CGST, and SGST automatically.

- E-Accounting Platforms: Provide real-time tax reports and audit support.

Tip for Students: Practicing with Tally Prime or similar platforms improves efficiency.

Practical Examples

- Example 1: A bakery in Yamuna Vihar sells cakes to a café in the same area.

- Invoice shows CGST + SGST → Intra-state supply.

- Example 2: A stationery supplier in Uttam Nagar sends orders to a client in Delhi.

- Invoice shows IGST → Inter-state supply.

- Example 3: Online orders across states using e-commerce platforms often trigger IGST automatically.

These examples demonstrate how GST laws are applied in everyday business transactions.

Suggested Courses for Students

Students seeking a career in finance, accounting, or taxation can benefit from structured learning:

- GST Certification Courses: Provide a clear understanding of tax rules.

- Tally Prime Training: Learn practical accounting and GST filing.

- E-Accounting and E-Filing Training: Enhances digital accounting skills.

Pro Tip: Choosing institutes offering hands-on GST and Tally Prime sessions in uttam nagar can give students practical exposure. Look for institutes in your area that provide professional training in accounting software and GST filing.

Conclusion

Identifying inter-state and intra-state supply is a core skill for students in accounting and taxation. Real-life examples, practical tools like Tally Prime, and structured courses make learning easier.

By mastering these concepts, students can confidently handle GST invoicing, reduce tax errors, and improve their employability. Learning through practical tools and real-world scenarios is always more effective than just theoretical study. VISIT USS…

Suggested Links: