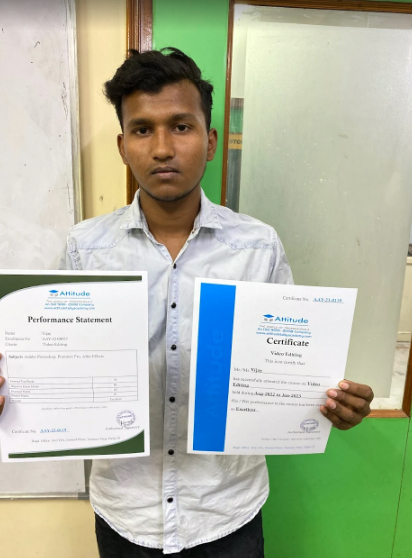

Take the final exam online to complete the after which you will be able to download your certificate from Attitude Trainings

Watch the recorded & live videos to learn various concepts & get Live Sessions for Doubts Clearing

Test your knowledge through quizzes & module tests

Get hands on practice by doing assignments and project

Take the final exam to get certified in

Watch the recorded & live videos to learn various concepts & get Live Sessions with Trainer for Doubts Clearing

Test your knowledge through quizzes & module tests

Get hands on practice by doing assignments and project

Take the final exam to get certified in

You can post your doubts on the Q&A forum which will be answered by the teachers within 24 hours.

I recently completed the Interior Designing training course at Attitude Academy, and it exceeded my expectations. The trainer's expertise and the excellent learning environment made the experience remarkable. The study material was top-notch, always up-to-date. Real industry assignments and hands-on projects provided invaluable practical experience. I'm grateful to Kajal mam for her job skills and interview handling sessions, which boosted my confidence.

It has been a great experience for me to take Autocad 3d's Max training from Attitude Academy. I have taken Autocad course. The trainer especially Mohsin Sir is very good and has good knowledge. I have also got a placement from here. The placement team is very good especially the Palak Mam is very helpful and provide good support in getting placement. Thanks Team Attitude Academy.

I am proud that I could participate this amazing course at the amazing Attitude Academy. It was an honor to work with knowledgeable tutors who helped us in all the ways possible. All I can say is Thank you Attitude Academy!